| 15-Jan-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,264.70 | 30.30 | 2.45% |

| Silver Price, $/oz | 17.07 | 0.12 | 0.69% |

| Gold/Silver Ratio | 74.076 | 1.276 | 1.75% |

| Silver/Gold Ratio | 0.0135 | -0.0002 | -1.72% |

| Platinum Price | 1,262.10 | 23.70 | 1.91% |

| Palladium Price | 766.35 | 14.30 | 1.90% |

| S&P 500 | 1,992.67 | -18.60 | -0.92% |

| Dow | 17,320.71 | -106.38 | -0.61% |

| Dow in GOLD $s | 283.11 | -8.73 | -2.99% |

| Dow in GOLD oz | 13.70 | -0.42 | -2.99% |

| Dow in SILVER oz | 1,014.51 | -13.27 | -1.29% |

| US Dollar Index | 92.57 | 0.29 | 0.31% |

|

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

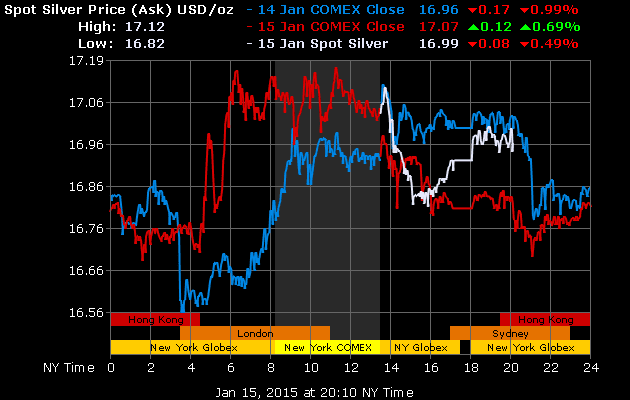

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

The SILVER PRICE broke through $16.80 about 5:30 and levitated strait sunward. Hit $17.20 dropped sharply but to a higher low, then bounced back to $17.20 -- all this by 8:00 a.m. Then it vibrated sideways, but couldn't overcome $17.20. Finally it fell back to $17.073 on Comex, up only 11.7 cents (0.7%).

What is that $17.20 line? The downtrend line from the August 2013 high. Remember the Dow in Gold is balking coming down at the uptrend line from August 2013. Silver should play catch up with the GOLD PRICE once it bursts through $17.20, running first and fast for $18.60.

I remind y'all that the upside-down head and shoulders y'all have been watching in gold has a measured target (height of the head added to the neckline at breakout) of US$1,350 (Thirteen hundred Fifty dollars). Today that breakout happened. Silver will follow. Panic fills the air : sudden Swiss franc abandonment of the euro, copper and other commodities falling after oil has already collapsed, stock markets tanking -- there's a smell of blood.

Buy the breakout! Buy the breakout! Buy the breakout!

GOLD/SILVER RATIO rose to 74.076, giving gold holders one last chance to swap gold for silver.

Swiss Nice Government Men, tired of sweating bullets last night and stunned markets by abandoning the link to the euro (SF1.20 = 1 euro). No surprise, the scabby Euro sank immediately 15% against the franc and rose nearly 16% against the scrofulous, fungus-riddled US dollar.

Since much of Switzerland's economy exports, Swiss stocks tanked as investors sold exporters, anticipating their sales shrinking thanks to a higher franc.

The Swiss National Bank criminals had promised in 2011 to keep a floor under the euro at $1.20. Only last month, (according to the New York Times, that prints all the news that fits) the SNB had reiterated its pledge to keep on supporting that floor by buying the euro in "unlimited quantities" if need be.

Well, I reckon that's about how long a central bank's word is good for, thirty days -- shucks, maybe longer than usual But you can sure put down as Gospel what the French say about lying government spokesmen, "Nothing is confirmed until officially denied." The euro might not survive this move.

Lo, yet another loud example of how well central banks stabilize markets.

It gets worse, and spreadeth wider. It appears that loads of Poles, Rumanians, and Bulgarians have granted mortgages in Swiss francs. Now they are obliged to repay in francs worth about 15% more. There's an object lesson in the Moneychanger Rule, NEVER borrow a currency that is likely to appreciate.

|

| Swiss Franc in Euro |

Y'all think about that.

Rest of the day wasn't just peachy for the World That Worships Central Banking, either. Today their god failed them.

Stocks continue to sink over the horizon, but 'tain't no rosy sunset here. Dow coughed up another 106.38 (0.61%) to 17,320.71; S&P500 shaved off 18.6 (0.92%) for a close at 1,992.67. Stocks sought to rally, but only early in the day. Rest of the day they looked like a skydiver with a faulty parachute. Believe it or not, yet more downside cometh.

Big gold jump today combined with Dow weakness pushed the Dow in Gold off the wall. Closed down G$9.51 gold dollars (3.25%) to G$283.62 (13.72 oz)! Not far from the 200 DMA at G$280.52 (13.57 oz). Today was the day the DiG fell out of the lower Gator Jaw, and hovers above punching through the uptrend line from August 2013. Once it breaches those supports, the pain will become gin'ral.

Although it fell 1.28% to S$1,320.82 silver dollars (1,021.57 oz), Dow in Silver hath not yet fallen out of the Gator Jaws. Close, but not there yet. Bottom Jaw stands about S$1,292.29 (1,000 oz).

Dow in Gold and Dow in Silver are SCREAMING that stocks have topped against metals: trend change. Yes, yes, a bit more confirmation is needed.

|

| US Dollar Index Intraday |

|

| Gold Price in Euro |

Japanese yen, safe on the other side of the earthball from Europe, keeps rallying, up another 0.97% today to 86.09, well above its 50 DMA. Blue sky above.

WTIC cast doubt on a two day completed key reversal by closing lower today, down 4.87% at $46.25/barrel. Three day uptrend still intact, though.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.