| 15-Apr-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,201.50 | 8.70 | 0.73% |

| Silver Price, $/oz | 16.27 | 0.12 | 0.73% |

| Gold/Silver Ratio | 73.852 | -0.001 | -0.00% |

| Silver/Gold Ratio | 0.0135 | 0.0000 | 0.00% |

| Platinum Price | 1,155.90 | 2.20 | 0.19% |

| Palladium Price | 766.80 | 4.60 | 0.60% |

| S&P 500 | 2,106.63 | 10.79 | 0.51% |

| Dow | 18,112.61 | 75.91 | 0.42% |

| Dow in GOLD $s | 311.63 | -0.96 | -0.31% |

| Dow in GOLD oz | 15.07 | -0.05 | -0.31% |

| Dow in SILVER oz | 1,113.32 | -3.43 | -0.31% |

| US Dollar Index | 98.58 | -0.42 | -0.42% |

|

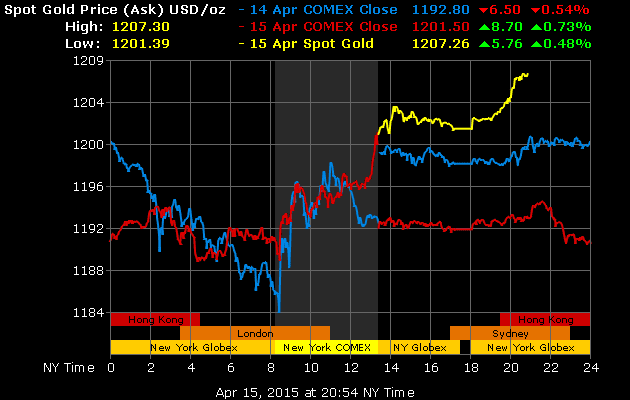

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

|

| Gold Price in USD |

Against the US dollar on Comex today the GOLD PRICE gained $8.70 (0.73%) to $1,201.50 while silver gained exactly the same percentage, 0.73%, by rising 11.8 cents to $16.269. I will forgo conspiratorial animadversions.

These repeated failures to break down when offered every opportunity makes me examine again the gold chart with more attention to that uptrend from the March low. Shucks, the GOLD PRICE closed above its 50 DMA today ($1,199.77) & ended the day $10 bucks higher than yesterday. Like a basketball under water, it doesn't want to stay below $1,200.

But leadership is shifting to gold from silver, which since December had been stronger. That you can see in the rising ratio. Also, the premium on US 90% has been $1.50 to $1.25 over spot at wholesale, has dipped to $1.10 today. In a market intending to rise, you'd expect that premium to rise, too.

This up & down can't last, but must resolve shortly by a clean, lasting break up or down. For the gold price, that means clearing not merely $1,210 but $1,225. The SILVER PRICE needs to o'erleap $17.00. Closes below this week's lows will pull both down.

Always good to keep in mind the context of a market, the broad backdrop against which it's trading. If you only look at a 3 month chart & see a strong rally, you may draw the wrong conclusion if you fail to place that rally against a 4 year down trend. And vice versa.

Just as stocks are faltering in a long-toothed uptrend, showing more sharp ups & downs, failing to gain much on good news, inching out an advance, and most of all, failing to make new highs, so silver & gold are acting just the opposite. Yesterday's apparent breakdown was reversed today. So just as a market failing at tops implies an uptrend is fizzling, so a market failing to fall further implies a downtrend turning up.

The US dollar index, king of the fiat currency leper colony, continued sliding today. Bear in mind these moves above 30 or so basis points are fairly big, moves above 50 scarce, and moves above 100 rare. Today it lost 42 basis points (0.42%) to close at 98.53, reinforcing yesterday's fall with another today. Dollar Index fell through that channel midline I've been watching, but not below the tripwire for further drops, the 20 DMA (98.31). That 100.27 we saw two days ago might have been no more than the top of a B-wave reaction, and upmove in a downtrend. So far the downtrend holds with lower highs, but needs a lower low below 96.32 to confirm.

|

| US Dollar |

Why, that there euro is just al-bustin' out the top of its barrel. Rose a big 0.3% today to end at $1.0688. Has sketched out a kind of double-bottomy thing, but shows little inclination to improve on that. Won't show any muscle at all until it crosses $1.1037. Yen is trying to rise & in fact has exceeded its 20 & 50 DMAs, but is tightly and shamefully rangebound still. Rose 0.23% today to 83.93. Below 84.50 it says nothing.

Stocks added a little today. The Russell 2000 did make an new all time high, but that's a small cap index. Market proverbs holds that "Cats & dogs fly last." In Southern that means, "Small cap stocks of contemptible standing rise at the last of an advance."

Dow rose 75.91 (0.42%) to 18,112.61 & S&P500 followed right along, up 10.79 (0.51%) to 2,106.63. Dow punched into but closed below its upper channel boundary, & the S&P500 did likewise. Old bulls die hard, but at last they die.

|

| Crude Oil |

Whoa! Look at that crude oil today! Spread its wings and flew! Rose 4.7% to close at $55.95 a barrel, way above the $54.15 top boundary. That also takes it above the longer term downtrend. Don't I remember them rationalizers & linear projectors saying oil was going to $20? Yeah, I do. Look for yourself, chart on the right.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.