| 15-Jan-16 | 22-Jan-16 | Change | % Change | |

| Gold Price, $/oz. | 1,091.50 | 1,097.20 | 5.70 | 0.5 |

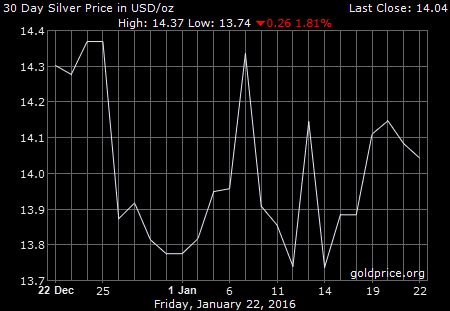

| Silver Price, $/oz. | 13.884 | 14.043 | 0.159 | 1.1 |

| Gold/Silver Ratio | 78.616 | 78.131 | -0.484 | -0.6 |

| Silver/gold ratio | 0.0127 | 0.0128 | 0.0001 | 0.6 |

| Dow in Gold $ (DIG$) | 302.80 | 303.13 | 0.33 | 0.1 |

| Dow in gold ounces | 14.65 | 14.66 | 0.02 | 0.1 |

| Dow in Silver ounces | 1,151.55 | 1,145.71 | -5.84 | -0.5 |

| Dow Industrials | 15,988.08 | 16,089.23 | 101.15 | 0.6 |

| S&P500 | 1,880.29 | 1,906.89 | 26.60 | 1.4 |

| US dollar index | 99.00 | 99.65 | 0.65 | 0.7 |

| Platinum Price | 825.70 | 829.70 | 4.00 | 0.5 |

| Palladium Price | 486.95 | 498.40 | 11.45 | 2.4 |

|

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

The GOLD PRICE lost $1.90 to $1,097.20 and the SILVER PRICE backed off 4¢ to $14.043. Sigh.

Silver keeps on pushing higher every day, today to $14.36, slugging toward that $14.40 hurdle. Something strange happened at High Noon: silver dropped in 5 minutes from $14.16 to $14.08. Demoralized it for the rest of the day. It's all right. Stage is set for more progress next week.

The GOLD PRICE made its peak on Wednesday and has since backed off in a normal correction -- so saith the five day chart. Remains above $1,090 support, but still must conquer $1,113. Silver and gold prices continue to throw themselves against overhead barriers, are slapped down, but snap right back. One of these days they will bust through the ceiling, and not too long.

Stocks barely managed to close the week up by rising today. US dollar index is swaying from side to side like a dog watching a tennis match. What! Platinum and Palladium rose!

Stocks continue the pattern of driving higher during the day, but slipping grip on most of the gain by day's end. Today the Dow lost about 40 points from the high, not counting the 40 points slipped in at the very close.

Dow gained 206.55 (1.3%) to barely throw a leg over 16,000 at 16,089.23. S&P500 jumped up 37.90 (2.03) to 1,906.89. Reaction rallies could carry as high at 16,600 and 1,950, but heed not the sirens who sing that stocks are coming back. They won't be, not in any time material to you and me.

As one scarred old bull who has been through several bull/bear cycles, let me remind y'all how the herd mentality works. People made money as stock rose, so in their minds sticks the belief they will ALWAYS make money buying stocks. As stocks decline, they listen ot the sirens saying, Buy more and double down. This continues until they run out of money and morale. The market slides further and further, until at last they sell. Precisely THERE will be the bottom. Thus passeth the life of an old bull.

After yesterday's humiliation, the US dollar index missed its chance to post a key reversal today. Instead, it rose 52 basis points to 99.65. That does not really atone for yesterday's sins. Yesterday the dollar index tried to enter new high territory and failed. Today it rose, but not nearly as high. None of this bears witness to underlying strength. Rather, it warns of spotty support and the possibility of large gaps down.

How do those people in Europe stand it? Their currency, I mean (y'all thought I meant something else.) Euro dropped 0.72% today to $1.0796. Below its 20 and 50 DMAs, its resting on the bottom boundary of an even-sided triangle where it can get an easy push off into the abyss. Sorry as gully dirt.

Yen dropped 0.89% to 84.15, back below its 20 DMA. Sorry, but not as sorry as the euro, and trying to rally, fueled by scared money in Asia.

I have a favor to ask of y'all. My bionic wife, Susan, is scheduled for minor eye surgery on Tuesday, 26 January 2016. I would appreciate your prayers for her and for a successful surgery. She is, after all, the apple of my eye. Thank you.

Y'all enjoy your weekend.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.