| 2-Mar-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,207.70 | -4.90 | -0.40% |

| Silver Price, $/oz | 16.41 | -0.11 | -0.64% |

| Gold/Silver Ratio | 73.609 | 0.176 | 0.24% |

| Silver/Gold Ratio | 0.0136 | -0.0000 | -0.24% |

| Platinum Price | 1,191.00 | 4.30 | 0.36% |

| Palladium Price | 830.30 | 11.85 | 1.45% |

| S&P 500 | 2,117.39 | 12.89 | 0.61% |

| Dow | 18,288.63 | 155.93 | 0.86% |

| Dow in GOLD $s | 313.04 | 3.92 | 1.27% |

| Dow in GOLD oz | 15.14 | 0.19 | 1.27% |

| Dow in SILVER oz | 1,114.68 | 16.60 | 1.51% |

| US Dollar Index | 95.51 | 0.19 | 0.20% |

|

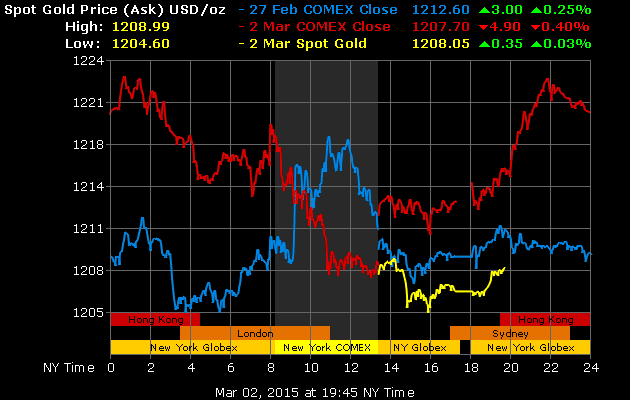

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

On a longer term chart, the gold price today rose to new high territory for the move that began last week. High hit that neckline y'all are tired of hearing about. That also just happens to make the downtrend line from the January high.

Now, I can look at this one of two ways, and I ain't got no drankin' glasses & ain't one of 'em half full and one half empty. Gold's entitled to take a run & back off at tough resistance, as any market is, but if it don't push on through $1,225, it mightdrop & scare y'all.

|

| Gold/Silver Ratio |

The SILVER PRICE tried to punch through its downtrend line with a $16.79 high, right where the 50 ($16.75) and 20 ($16.74) DMAs intertwined. Didn't make it. No damage done, but bad for morale. Can't keep doing this without risking a serious fall.

I thought about it over the weekend. I don't believe there is any more than $70 downside risk in gold, even after today's piddling performance. And the fact that nobody in creation is interested in gold adds to my conviction.

Yankee government did me in again today. Took Susan to Nashville to see her heart doctor. Had lunch on the west side with friends, so since we were near the Natchez Trace Parkway & it would get us home in 1-1/2 hours, I headed that way. Passed the Loveless Café and there was a "Road Closed" sign. What? Went around another way to the next entrance & it was closed, too. I had to wind around through Franklin & Thompson's Station got caught in school traffic & generally turned a 1-1/2 hour trip into nearer four. I was some kind of pleased.

That's why I live in the country. When trees fall across our gravel roads, we just reach in the back of the truck, pull out a chainsaw, & clear the road. That's the country way. Besides, you'd wait a month for the county to get around to it.

Somebody let the stock dogs off their leash today, & they just bought up everything in sight. Pushed the Nasdaq Composite over 5,000 for the first time since March 2000. That all time high that standeth yet was 5,048.62 on 10 March 2000. Lawsie me! Didn't the stock touts like to blow out their touters touting that Nasdaq!

Yes, but I don't believe 'em any more than Trojans believed Cassandra at Troy. It might be pointing out the exact opposite, here after a stock bull market has been raging (thanks to the central bank money fountain) since 2009. Might be making a prophetic double top. But I don't know Cassandra from Adam's off ox, & only Troy I ever been to is Troy, Alabama, on the way to Dothan.

|

| Dow in Gold |

|

| Dow in Silver |

What am I talking about? What's the significance of the top Gator Jaw? Gator Jaws are big broadening top patterns (megaphones). They usually resolve with frustrating sloth, but they are also very reliable. The gator jaws chew slow, but they chew exceeding fine, moving high & low across the pattern. To gainsay & invalidate this pattern, both would have to close more than 3% above the top gator jaw.

That ain't all. These indicators are "spreads" showing the performance of stocks against gold & silver. When they turn down, that will signal that the price downtrend in silver & gold prices as well as stocks' uptrend against metals have reversed. In other words, they gonna punch our ticket!

The US 10 year treasury note yield rose today (US treasury prices declined). Reuters reported that large corporate debt sales in advance of an anticipated interest rate boost by the Fed was pressuring prices. I reckon I can believe that, I just can't believe anyone would loan corporations money (buy their bonds) at this low rate. There's that nat'ral born durned fool from Tennessee talking again.

US dollar index rose 19 basis points (0.19%) to 95.51. I reckon I can now admit it has me bumfuzzled. Rose up out of a triangle against a fall which would have made more sense, but must better 95.85 before it confirms another upleg. It's embarrassing to have to talk about the Yen & Euro. Euro fell another 0.11% to $1.1185 and is bumping at the very bottom of its range, like scrubbing a hole plumb through your bathtub. Yen fell to the bottom of its range, off 0.43% to 83.23.

Do y'all realize that if the world didn't have these scrofulous fiat currencies sucking on its neck like Dracula on a pretty girl, I wouldn't have anything to write about? And y'all could spend your time doing better things, like straightening up your sock drawer.

WTIC still refuses to break down. Rose 0.55% to $49.79/barrel.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.