| 18-Mar-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,151.40 | 3.10 | 0.27% |

| Silver Price, $/oz | 15.53 | -0.04 | -0.24% |

| Gold/Silver Ratio | 74.164 | 0.376 | 0.51% |

| Silver/Gold Ratio | 0.0135 | -0.0001 | -0.51% |

| Platinum Price | 1,093.60 | -1.10 | -0.10% |

| Palladium Price | 764.30 | -2.50 | -0.33% |

| S&P 500 | 2,099.50 | 25.22 | 1.22% |

| Dow | 18,076.19 | 227.11 | 1.27% |

| Dow in GOLD $s | 324.53 | 3.21 | 1.00% |

| Dow in GOLD oz | 15.70 | 0.16 | 1.00% |

| Dow in SILVER oz | 1,164.33 | 17.36 | 1.51% |

| US Dollar Index | 98.10 | -1.85 | -1.85% |

|

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

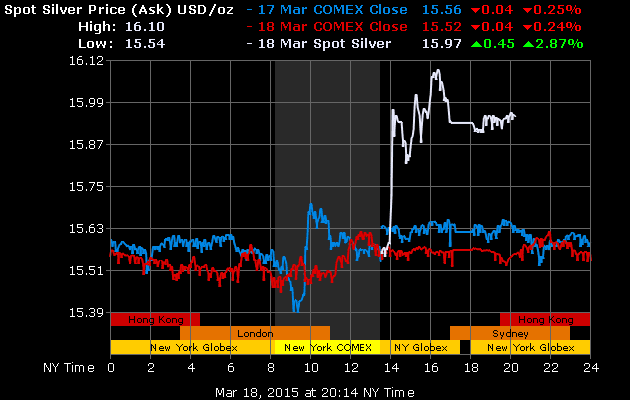

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

But lo & behold, came the FOMC announcement and both -- I won't say it again -- rocketed. The GOLD PRICE ended the day at $1,168.70, up 1.8% or $20.40 from yesterday's Comex close. Silver ended at 16.02, up 45.8 cents or 2.9% from yesterday's Comex.

The gold price shot away from that shoulder support line & toward its upper downtrend channel line. It has certainly turned around for a while, but that turnaround must pass the test Gold failed in January at $1,308. Today turned up most momentum and trend indicators.

GOLD/SILVER RATIO ended at 74.08, lower but not yet ideal.

The SILVER PRICE ricocheted from the bottom of that falling wedge to the top side, but didn't quite break through. Looks stronger than gold, & both silver & gold prices should continue higher tomorrow. Silver's re-test comes at January's $18.50 high.

For one of the most ridiculous market charts in world history, go to www.nasdaq.com and click on "DJIA." Market is underwater until moments before the FOMC's announcement, then shoots up over 220 points. Looks like a chart from a movie I saw one time, "The Three Stooges Visit Wall Street."

Bottom line of the Fed's announcement was that it would raise rates, but not before June, and maybe not until September. Stock market interpreted this as "Pour more PGA in the punch bowl" so stocks shot up. Dollar index interpreted this as "Dollar interest rate not going higher soon," & so shot down. Bond prices took it as "Lower interest rates for a while" and so yields shot up while prices shot down (they always move opposite to each other. It's mathematical." Dollar sank, so silver & gold shot up.

Daddurn! There was a lotta shootin' goin' on!

Listen to me: this is dumb, dumb, dumb. This is not investing, not an economy, not even a casino, unless it would be a rigged casino. The end of this is grief, wailing, weeping, & gnashing of teeth. When things don't make sense, it's usually because -- they don't make sense.

At today's low the Dow stood at 17,697.52, 378.67 points LOWER than 18,076.19 where it closed. That was a rally -- all after 2:00 p.m. -- that took the Dow up today 227.11 or 1.27%. S&P500 rose 25.22 or 1.22% to 2,099.50

Gold rose, too, but later in the day but weren't as manic as stocks. Dow in Gold closed at G$324.55 gold dollars (15.70 troy ounces). Silver poked thru the upper gator jaw to S$1,503.84 silver dollars (1,163.13 troy ounces). Either this rise will end soon, or it will invalidate the gator jaws. Y'all know what I expect.

US dollar Index fell off a cliff, down, down, down 185 basis points (1.85%) a huge move. That should begin a correction of at least a couple of weeks, but gives no sign yet it will do more than routinely correct. Clearly, the Fed wants the dollar lower and today was the first shot of the jawbone in talking it down.

The moribund euro -- clumsy, hapless oaf of scrofulous fiat currencies -- shot up out of its sub-cellar dungeon and actually closed up 2.52% at $108.63. That was not enough to clear the downtrend line or the 20 DMA, but it did punch into the 20 DMA before selling much lower. Probably hath turned cloudward for a while.

Yen gained 1.04% to 83.28. Above 20 DMA, rangebound. BoJ probably likes it that way.

Bond prices rose sharply, pulling yields down. US 10 year treasury note yield lost 5.2% to 1.951%. Below 50 DMA. Oooooo.

West Texas Intermediate Crude jumped a meaty 9.955 to close at $46.65/barrel. Working on a bottom.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.