Change: -3.8 or -0.42%

Silver Price Close Today : $12.76

Change: 0.3 cents or 0%

Gold Silver Ratio: 69.82

Change: -0.28 or -0.4%

Dow Industrial: 7,920.18

Change: -137.63

SILVER and GOLD PRICES rallied strongly yesterday, helped no doubt by dollar weakness, but they gave back a little today. Gold held on above 889, a strong support level.(closed down 3.80 at US$890.90). The silver price rallied strongly yesterday, too, but only gave up 0.3 cent today to close at 12.76.

I can't make up my mind yet whether silver and gold prices will make one last downward swoon before they finish this correction, or not. Downside they have made lows at 12.105 and 871.5, but if the correction has ended then they should not again visit levels that low. If the gold price climbs above 906 and silver over 13.06, don't expect any more downside.

Stocks today disappointed, deciding with blithe schizophrenia that the market no longer like financial stocks. The Dow dropped 137.63 to 7,920.18 and the S&P500 fell 17.23 to close at 841.50. This wild back and forth is characteristic of bear market rallies and their sudden shifts, as well as the market's completely unsettled mind. Rally is not over yet.

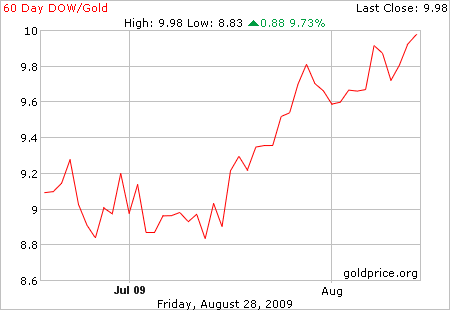

The Dow in Gold Dollars appears to have double topped just above G$189 (9.15 oz), which might signal an upward turnaround in gold.

The gold/silver ratio has also turned down, but not yet unequivocally.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.