| 30-Nov-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,065.80 | 9.60 | 0.91% |

| Silver Price, $/oz | 14.05 | 0.04 | 0.30% |

| Gold/Silver Ratio | 75.858 | 0.458 | 0.61% |

| Silver/Gold Ratio | 0.0132 | -0.0001 | -0.60% |

| Platinum Price | 832.30 | -0.70 | -0.08% |

| Palladium Price | 541.95 | -7.65 | -1.39% |

| S&P 500 | 2,080.41 | -9.70 | -0.46% |

| Dow | 17,719.92 | -78.57 | -0.44% |

| Dow in GOLD $s | 343.69 | -4.66 | -1.34% |

| Dow in GOLD oz | 16.63 | -0.23 | -1.34% |

| Dow in SILVER oz | 1,261.20 | -9.39 | -0.74% |

| US Dollar Index | 100.21 | 0.14 | 0.14% |

|

| 3 Day Gold Price Chart |

|

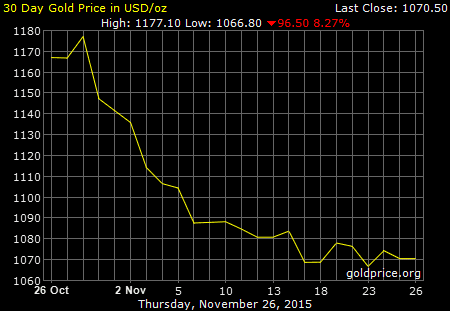

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

While the Big Cats are away, the little nasty mice will play. Floor traders often play on holiday thinned markets like Thanksgiving. Since they know where the stops are, they're easy to run. Then the market recovers and the day has little effect. On Friday, then, the GOLD PRICE dropped $13.80 to close it's very short holiday trading day at $1,056.20 on Comex, lowest since 2011 peak. Silver, however, did NOT confirm with a lower close, although it lost 15 cents to $14.008. Nor did gold stock indices confirm with lower closes. All that promises positive days.

Over the weekend, on Saturday, the price of gold again tumbled toward its Friday low about $1,054, but recovered and came back strongly today. So far, so good. If Friday didn't make the low, it ought to come in December's first half.

SILVER painted a like picture over the weekend, with a $13.93 low on Friday, and a $14.01 low on Saturday, followed by a less than sterling recovery today.

So, what do we have? A new low for gold Friday with silver and gold stocks refusing to confirm. Bullish Commitments of Traders stats for both silver and gold. End of seasonal period for silver and gold lows. Jupiter aligning with Mars -- no, wait, wait, that's not in there -- Strike that. Finally, we have central bank criminals working hard as they can to destroy their currencies, carrying historically unimagined policies to absurd, preposterous lengths. Yep, sounds like a recipe for resuming the silver and gold bull market to me, but shucks! I ain't no New York smarty. I'm just a nat'ral born durned fool from Tennessee.

Now what silver and gold prices need is just some positive reversal sign. Jes' y'all wait. It's comin'.

International Monetary Fund, scourge of benevolent human beings everywhere, today accepted the Chinese yuan into its reserve currency basket for its phony currency unit, the Special Drawing Right. Before the SDR contained only the US dollar, euro, pound sterling, and yen. The inclusion won't take effect until 1 October 2016. Weightings will be: US dollar, 41.73%, Euro 30.93%, yen 8.33%, pound 8.09%, and yuan 10.92%. This seats China at the table with the Big Boys.

The decision makes yuan-denominated assets available to central bank portfolios. It is a harbinger of the US dollar's decline as the bull reserve currency. With that decline goes US global hegemony, but don't discount the US yet. It's still the only country whose currency is backed by an army that will invade your country if you squawk about its foot on your neck.

With all that cheerful news behind us, let's turn to stocks. They had a headache today. Friday was confused with some indices barely up, some barely down, but today the bewilderment dissipated as every index plopped. Dow lost 78.57 or 0.44% to 17,719.92. S&P500 edged down 9.7 (0.46%) to 2,080.41. These are not in themselves death dealing changes, but the Dow closed just below its 20 day moving average and the S&P500 squatted down dead on its 20 DMA. That promises lower prices.

Friday's hijinks in silver and gold prices brought about slightly higher highs in the Dow in gold (16.85 oz.) and Dow in Silver (1,265 oz). Dow in silver is as overbought as antimacassars at an old ladies' convention. Both fell today.

|

| US Dollar |

What can I say about the euro? What more contempt and scorn can I heap up? What other colorful rotten tomatoes can I throw at it, despicable political Frankenstein of authoritarian bureaucrats, thirsty vampire of national economies? Greedy tick on the armpit of nations? Revolting tapeworm in the body economic? Well, lots if I put my mind to it as it deserves. It fell again, 0.24% to $1.0569. At least its rate of fall is falling. I reckon that's saying something good, but no more'n I have to.

The Yen dropped 0.18% to 81.25.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.