Gold Price Close Today : 953.70

Gold Price Close 24 July: 952.80

Change: 0.90 or 0.1%

Silver Price Close Today : 13.933

Silver Price Close 24 July: 13.87

Change: 6.30 cents or 0.5%

Platinum Price Close Today: 1,211.40

Platinum Price Close 24 July: 1,189.40

Change: 22.000 or 1.8%

Palladium Price Close Today: 263.00

Palladium Price Close 24 July: 261.95

Change: 1.050 or 0.4%

Gold Silver Ratio Today: 68.45

Gold Silver Ratio 24 July: 68.70

Change: -0.25 or -0.4%

Dow Industrial: 9,171.61

Dow Industrial 24 July: 9,093.24

Change: -25.62 or -0.3%

US Dollar Index: 78.317

US Dollar Index 24 July: 78.813

Change: -0.496 or -0.6%

'Twas a strange week, a weird week.

The US DOLLAR rallied 100 basis points quite suddenly, sending gold & silver into a sharp correction. Today that all reversed.The US DOLLAR INDEX fell 100.1 basis points back to the very scraping bottom of its range, 78.317. Now this either confirms that 78.33 bottom on 2 June & 28 July, or, it will break thru that 78.33 level to drop another 200 bips, and maybe hit 76. Remember, when markets repeatedly test a resistance or support level, chances are they will break thru. More downside is most likely US Dollar course.

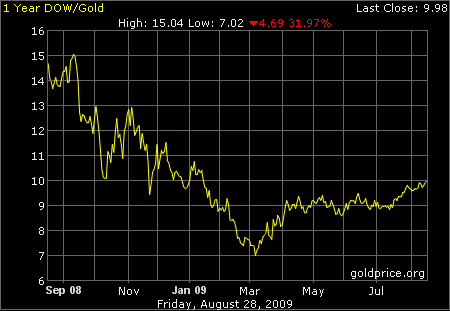

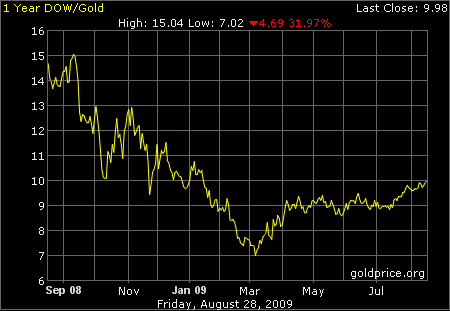

The last two weeks I have mentioned the Dow in Gold Dollars, watching to see if stocks could break out upside against gold. This week the DiG$ did climb to the 200 DMA & through it to a high of G$202.15 (9.779 oz), but has since fallen back. I don't think stocks are about to rally strongly against gold. Rather, they are at the top of their correction in terms of gold, but not necessarily in dollar terms. So even if stocks rally to 9,700 Dow, don't expect them to gain much against gold.

STOCKS, I suspect, are very strong right now, since the world is full of gnat-wits who have a four second attention span and believe that 200-year Depressions end after 10 months. Alas! The market is not kind, the market is not benevolent. In a bear market, money returns to its rightful owner. Don't be one of those who are fooled. Sell stocks into this rally. Put the proceeds into silver and gold, fast.

Weird week. After plunging as low as US$927.20 this week (Behold! Our 928 support level held!) the gold price actually closed this week 90 symbolic cents higher than last week.

Okay, to fall sharply, then recover all the lost ground plus a teents, is strong, but how strong? Clearly a large and well-walleted gold fan club sits waiting to take on all sellers at US$928. However, why didn't the gold price go all the way and close above US$955, which has been blocking it? Don't know, but that is the next logical step, a close over US$955, if gold is to continue this rally. Watch and mark what gold does on Monday. I am inclined to expect the gold price will rise upward towards US$980 next week.

For the week the silver price rose 6.3 cents, but as with the gold price, that doesn't tell the tale. The silver price crashed to 13.253 on 7/29, its second terrible day. Yet again, as with gold, what do you say of a market that drops like a rock, then comes right back to close higher. You say it is strong, then humbly put your hand over your mouth. You say that the weak holders were shaken out, and the strong holders are sitting under the market like trolls under a bridge, ready to gobble down any cheap silver that falls off.

Whoa! The metaphors just keep on coming! I am still watching the dollar over my shoulder, because it has by no means -- even with today's big drop -- put itself outside reach of rallying and thus striking a blow at silver and gold. But if the buck dawdles too long, gold will hit US$1,000 and earth-orbit escape velocity and 'twill be too late for the dollar.

Y'all keep on buying silver and gold. Buy on the dips. Buy in the teeth of your fears it will drop again below 900 and 13.00. Buy, and leave no room for fear. Even if big drops were to hit, both are still in bull markets and that rising tide will raise your boat and mercifully leave your timing mistakes beneath the waves.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Friday, July 31, 2009

Wednesday, July 29, 2009

The Gold Price had Better Not Drop Below $909

Gold Price Close Today : 927.20

Change: -11.90

Silver Price Close Today : 13.253

Change: -48.2 cents

Platinum Price Close Today: 1174.40

Change: -25.00 or -2.1%

Palladium Price Close Today: 252.20

Change: -3.00 or -1.2%

Gold Silver Ratio Today: 69.97

Change: 1.61 or 2.35

Dow Industrial: 9,070.72

Change: 26.00 or 0.3%

US Dollar Index: 78.51

Change: 0.64 or 0.8%

Today the somewhat less than Almighty US DOLLAR INDEX rallied 63.5 basis points to 79.509. That didn't help silver, gold, or stocks. Note, however, that all three were already over-extended when the dollar began to rally, & dollar or no, would have corrected anyway.

The Dollar's chart confuses me a bit. This last leg down ought to have carried further than the last (June) low at 78.33 intraday -- but it stopped short and rallied. The move will have to be accounted a rally if it gets above the present channel's top downtrend line, today about 80.25. Otherwise the Dollar ought to have more downside in its future.

STOCKS have lost upward momentum but haven't fallen yet. They will, but only in a correction, I suspect, before higher prices.

The GOLD PRICE fell off 11.90 today to close at 927.20. That's close enough to count as within the 928 - 930 support. More support lies at 920 - 918, then 912. For technical reasons too complicated to explain here but explained in this month's monthly Moneychanger, the gold price had better not drop below 909. That would signal a terrible and long correction, 3 - 6 months. Personally, I have to bet against that. The gold price fought to hold in this area, then trade sideways through early August -- but the market speaks and I, in humility and sometimes humiliation, listen.

The SILVER PRICE skidded down 48.2 cents to a stop at 13.253. Surprised? You oughtn't be, because the silver price is volatile, so these swings belong to the silver market. Tighten your belt, get used to it. Bottom of this decline ought to be here or 13.00. Now is the time to buy both silver and gold.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: -11.90

Silver Price Close Today : 13.253

Change: -48.2 cents

Platinum Price Close Today: 1174.40

Change: -25.00 or -2.1%

Palladium Price Close Today: 252.20

Change: -3.00 or -1.2%

Gold Silver Ratio Today: 69.97

Change: 1.61 or 2.35

Dow Industrial: 9,070.72

Change: 26.00 or 0.3%

US Dollar Index: 78.51

Change: 0.64 or 0.8%

Today the somewhat less than Almighty US DOLLAR INDEX rallied 63.5 basis points to 79.509. That didn't help silver, gold, or stocks. Note, however, that all three were already over-extended when the dollar began to rally, & dollar or no, would have corrected anyway.

The Dollar's chart confuses me a bit. This last leg down ought to have carried further than the last (June) low at 78.33 intraday -- but it stopped short and rallied. The move will have to be accounted a rally if it gets above the present channel's top downtrend line, today about 80.25. Otherwise the Dollar ought to have more downside in its future.

STOCKS have lost upward momentum but haven't fallen yet. They will, but only in a correction, I suspect, before higher prices.

The GOLD PRICE fell off 11.90 today to close at 927.20. That's close enough to count as within the 928 - 930 support. More support lies at 920 - 918, then 912. For technical reasons too complicated to explain here but explained in this month's monthly Moneychanger, the gold price had better not drop below 909. That would signal a terrible and long correction, 3 - 6 months. Personally, I have to bet against that. The gold price fought to hold in this area, then trade sideways through early August -- but the market speaks and I, in humility and sometimes humiliation, listen.

The SILVER PRICE skidded down 48.2 cents to a stop at 13.253. Surprised? You oughtn't be, because the silver price is volatile, so these swings belong to the silver market. Tighten your belt, get used to it. Bottom of this decline ought to be here or 13.00. Now is the time to buy both silver and gold.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Tuesday, July 28, 2009

Gold Price Sneezes, Silver Price Gets Pneumonia

Gold Price Close Today : 939.10

Change: -14.40 or -1.5%

Silver Price Close Today : 13.735

Change: -25.0 cents or -1.8%

Platinum Price Close Today: 1199.80

Change: 34.90 or 3.0%

Palladium Price Close Today: 259.45

Change: 0.95 or 0.4%

Gold Silver Ratio Today: 68.37

Change: 0.193 or 0.3%

Dow Industrial: 9,082.89

Change: -25.62 or -0.3%

US Dollar Index: 78.91

Change: 0.28 or 0.4%

Today I have to write at 1:40 p.m. CST instead of closes, as I must leave early.

As I expected yesterday, the GOLD PRICE dropped today, but by more than expected, down $14.40 to US$939.10. The size of the drop hints at the weakness at US$955. As long as gold remains above US$930, it ought to resume its uptrend shortly.

Gold sneezes, silver gets pneumonia. The SILVER PRICE dropped 25 cents today to $13.7350, bouncing off $14.00. As long as silver remains above $13.25, uptrend remains.

The US DOLLAR INDEX's small move up today, 27.8 basis points to 78.908, argues that gold's drop today was not occasioned by US dollar strength. I am more concerned that gold is not progressing against currencies across the board than I am about the US dollar.

STOCKS here before the close are down slightly. Dow is down 25.62 to 9,082.89 and SAP down 4.19 to 978.06. Do y'all feel like markets are becoming a casino? Hard to make sense out of anything when the world is lurching from crisis to crisis, pushing governments and central banks from radical intervention to never-before-imagined intervention.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: -14.40 or -1.5%

Silver Price Close Today : 13.735

Change: -25.0 cents or -1.8%

Platinum Price Close Today: 1199.80

Change: 34.90 or 3.0%

Palladium Price Close Today: 259.45

Change: 0.95 or 0.4%

Gold Silver Ratio Today: 68.37

Change: 0.193 or 0.3%

Dow Industrial: 9,082.89

Change: -25.62 or -0.3%

US Dollar Index: 78.91

Change: 0.28 or 0.4%

Today I have to write at 1:40 p.m. CST instead of closes, as I must leave early.

As I expected yesterday, the GOLD PRICE dropped today, but by more than expected, down $14.40 to US$939.10. The size of the drop hints at the weakness at US$955. As long as gold remains above US$930, it ought to resume its uptrend shortly.

Gold sneezes, silver gets pneumonia. The SILVER PRICE dropped 25 cents today to $13.7350, bouncing off $14.00. As long as silver remains above $13.25, uptrend remains.

The US DOLLAR INDEX's small move up today, 27.8 basis points to 78.908, argues that gold's drop today was not occasioned by US dollar strength. I am more concerned that gold is not progressing against currencies across the board than I am about the US dollar.

STOCKS here before the close are down slightly. Dow is down 25.62 to 9,082.89 and SAP down 4.19 to 978.06. Do y'all feel like markets are becoming a casino? Hard to make sense out of anything when the world is lurching from crisis to crisis, pushing governments and central banks from radical intervention to never-before-imagined intervention.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Monday, July 27, 2009

The Silver Price Continues to Outperform the Gold Price

Gold Price Close Today : 953.50

Change: 0.50 or 0.1%

Silver Price Close Today : 13.985

Change: 11.5 cents or 0.8%

Platinum Price Close Today: 1,224.30

Change: 34.90 or 2.9%

Palladium Price Close Today: 262.90

Change: 0.95 or 0.4%

Gold Silver Ratio Today: 68.18

Change: -0.529 or -0.8%

Dow Industrial: 9,093.24

Change: 23.95 or 0.3%

US Dollar Index: 78.65

Change: -0.21 or -0.3%

You can say the same thing about markets that we say about the weather in Tennessee: "If you don't like it, just wait a while. It's bound to change." One great hurdle to reading markets is our own human tendency to project today into tomorrow -- forever. But if markets were easy to read, then everybody would be rich, good looking, and nobody would have bad breath. We all know markets are just the opposite. About the time you think you've got them absolutely scoped out, they do exactly the opposite. So about twice a day you have to slap yourself -- hard -- and ask, "What if I'm all wrong?"

Hence I invite y'all today to meditate on the US DOLLAR INDEX. It appears to me to be headed for oblivion, right after it crashes through 76. Then I look at that chart from another angle and wonder whether it might not catch around 77.70, grab hold, and fool us all by rallying for 3 - 6 months. Need I add that would put a hurricane headwind in the faces of silver and gold? And stocks?

Ponder the GOLD PRICE chart as well. Gold seems to have leaden feet, although it keeps climbing. Silver and Platinum aren't bothered, but gold stays slow. For the past 2 weeks the SILVER PRICE has risen twice as fast as gold. Nor do I like the gold/silver ratio chart, either.

Wall Street says, "Bull markets always climb a wall of worry." Perhaps I am only worrying, but markets often blindside the unwary. I'm not implying that the long term bull market for silver and gold has changed, only that the next three to six months might hold hardship for silver and gold investors, depending on what the less-than-almighty US dollar does.

Today the US DOLLAR INDEX merely continued to drop, down 21 basis points to 78.647. Past lows occurred at 78.33 and 77.70, so the dollar will find support at those levels. Below that is only 76.

GOLD rose a dainty fifty cents today to close at $953.30. The actual barrier here is $955, so that's the goal, a close above $955. At any close above $940 the uptrend remains intact. Main chance for tomorrow is a lower gold price,but not by much.

SILVER continues to outperform gold, rising again today 11.5 cents to close on Comex at $13.985. That looks like a cheap shot from the Nice Government Men to me, since a lousy 1.5 cents would have put silver over the psychologically crucial $14.00 cents. Regardless, it traded up to $14.05 right after Comex close.

Speaking of NGM, stocks smelled largely of mackerel today. The Dow remained below Friday's close literally all day, then popped up for a 15.27 point gain in the last 15 minutes of trading. Yep, that's possible, but is it likely outside some parallel universe? Still not clear to me whether stocks will proceed to 9,700 or break down from here.

DOW IN GOLD DOLLARS still cannot pierce G$197 (9.530 oz). Once it broke through G$194, it should have moved quickly higher, but has not, having been blocked at G$197. Doesn't say much for stocks outperforming gold in the near future.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: 0.50 or 0.1%

Silver Price Close Today : 13.985

Change: 11.5 cents or 0.8%

Platinum Price Close Today: 1,224.30

Change: 34.90 or 2.9%

Palladium Price Close Today: 262.90

Change: 0.95 or 0.4%

Gold Silver Ratio Today: 68.18

Change: -0.529 or -0.8%

Dow Industrial: 9,093.24

Change: 23.95 or 0.3%

US Dollar Index: 78.65

Change: -0.21 or -0.3%

You can say the same thing about markets that we say about the weather in Tennessee: "If you don't like it, just wait a while. It's bound to change." One great hurdle to reading markets is our own human tendency to project today into tomorrow -- forever. But if markets were easy to read, then everybody would be rich, good looking, and nobody would have bad breath. We all know markets are just the opposite. About the time you think you've got them absolutely scoped out, they do exactly the opposite. So about twice a day you have to slap yourself -- hard -- and ask, "What if I'm all wrong?"

Hence I invite y'all today to meditate on the US DOLLAR INDEX. It appears to me to be headed for oblivion, right after it crashes through 76. Then I look at that chart from another angle and wonder whether it might not catch around 77.70, grab hold, and fool us all by rallying for 3 - 6 months. Need I add that would put a hurricane headwind in the faces of silver and gold? And stocks?

Ponder the GOLD PRICE chart as well. Gold seems to have leaden feet, although it keeps climbing. Silver and Platinum aren't bothered, but gold stays slow. For the past 2 weeks the SILVER PRICE has risen twice as fast as gold. Nor do I like the gold/silver ratio chart, either.

Wall Street says, "Bull markets always climb a wall of worry." Perhaps I am only worrying, but markets often blindside the unwary. I'm not implying that the long term bull market for silver and gold has changed, only that the next three to six months might hold hardship for silver and gold investors, depending on what the less-than-almighty US dollar does.

Today the US DOLLAR INDEX merely continued to drop, down 21 basis points to 78.647. Past lows occurred at 78.33 and 77.70, so the dollar will find support at those levels. Below that is only 76.

GOLD rose a dainty fifty cents today to close at $953.30. The actual barrier here is $955, so that's the goal, a close above $955. At any close above $940 the uptrend remains intact. Main chance for tomorrow is a lower gold price,but not by much.

SILVER continues to outperform gold, rising again today 11.5 cents to close on Comex at $13.985. That looks like a cheap shot from the Nice Government Men to me, since a lousy 1.5 cents would have put silver over the psychologically crucial $14.00 cents. Regardless, it traded up to $14.05 right after Comex close.

Speaking of NGM, stocks smelled largely of mackerel today. The Dow remained below Friday's close literally all day, then popped up for a 15.27 point gain in the last 15 minutes of trading. Yep, that's possible, but is it likely outside some parallel universe? Still not clear to me whether stocks will proceed to 9,700 or break down from here.

DOW IN GOLD DOLLARS still cannot pierce G$197 (9.530 oz). Once it broke through G$194, it should have moved quickly higher, but has not, having been blocked at G$197. Doesn't say much for stocks outperforming gold in the near future.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Friday, July 24, 2009

Next Week Gold Might Correct, But Not Lower than $930

Gold Price Close Today : 952.80

Gold Price Close 17-Jul : 937.20

Change: 15.60 or 1.7%

Silver Price Close Today : 13.87

Silver Price Close 17-Jul : 13.398

Change: 47.20 cents or 3.5%

Platinum Price Close Today: 1,189.40

Platinum Price Close 17-Jul : 1,173.60

Change: 15.800 or 1.3%

Palladium Price Close Today: 261.95

Palladium Price Close 17-Jul : 249.00

Change: 12.950 or 5.2%

Gold Silver Ratio Today: 68.70

Gold Silver Ratio 17-Jul : 69.95

Change: -1.26 or -1.8%

Dow Industrial: 9,093.24

Dow Industrial 17-Jul : 8,743.94

Change: 349.300 or 4.0%

US Dollar Index: 78.813

US Dollar Index 17-Jul : 79.478

Change: -0.665 or -0.8%

The GOLD PRICE rose US$15.60 this week to close the week at US$952.80, but on Comex today it closed down $1.70. Gold smashed through $940 like the Jackson through Hooker's Union army at Chancellorsville, then ran to $954, the next resistance. It couldn't quite clear that mark, but has another chance next week, and a chance to clear $968. Even if this rally is destined to fail at US$1,000 (which I doubt), it's virtually certain to reach US$980. Next week gold might correct, but not lower than $930. In fact, I don't believe we will ever see gold drop below $909 again.

Again this week, the SILVER PRICE rose twice as fast as gold, closing the week at $13.87, up 47.2c for the week and 10.5c for the day (Comex close). Silver has now beaten $13.80 resistance, but I really want to see it close above $14.25 to feel more comfortable. The Grand Resistance silver must beat is $16.50.

I think the danger of $12.00 silver has passed,and the rest of the summer will be spent with silver and gold trading in sometimes frustrating sideways direction, but generally upward. Don't let the rally in stocks distract you. Silver and gold are headed higher.

Big news today is that the Dow in Gold Dollars, to which I pointed y'all last week, broke through G$194 (9.385 oz) resistance and has run to its 200 day moving average. It might stop there, or it might rise as high as G$215 (10.401 oz). For a short time, expect stocks to outperform gold, as long as eight weeks. However, this is a countertrend rally. Since August 2009 the DiG$ has fallen from G$925.42 (44.767 oz) to today's G$197.26 (9.544 oz), or 78.7%. This bear market (of stocks in terms of gold) will continue until the whole Dow costs G$41.34 (2.000 oz) or less, once this little countertrend rally ends.

STOCKS showed great confusion today. Dow rose 23.95 to 9,093.24, S&P rose 2.97 to 979.26, while Nasdaq fell 7.64 to 1,965.96, Nasdaq 100 fell 2.42 to 1,599.06. All the rest of the indices were likewise mixed. Now two paths are possible. First, stocks gasp and fail here, about Dow 9000. Second, stocks reach Dow 9,700, then collapse. Either way, anyone who still owns stocks ought to take this as a rare, God-given opportunity to sell them and put the proceeds into silver and gold. You won't get another chance at these levels.

The US DOLLAR index today closed down another 18 basis points at 78.813. It has lost 67 basis points since last week. Literally it has reached the bottom of its range. If it falls more, then it will fall another 200 basis points or more. Get busy, Nice Government Men! You have a market to manipulate!

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Gold Price Close 17-Jul : 937.20

Change: 15.60 or 1.7%

Silver Price Close Today : 13.87

Silver Price Close 17-Jul : 13.398

Change: 47.20 cents or 3.5%

Platinum Price Close Today: 1,189.40

Platinum Price Close 17-Jul : 1,173.60

Change: 15.800 or 1.3%

Palladium Price Close Today: 261.95

Palladium Price Close 17-Jul : 249.00

Change: 12.950 or 5.2%

Gold Silver Ratio Today: 68.70

Gold Silver Ratio 17-Jul : 69.95

Change: -1.26 or -1.8%

Dow Industrial: 9,093.24

Dow Industrial 17-Jul : 8,743.94

Change: 349.300 or 4.0%

US Dollar Index: 78.813

US Dollar Index 17-Jul : 79.478

Change: -0.665 or -0.8%

The GOLD PRICE rose US$15.60 this week to close the week at US$952.80, but on Comex today it closed down $1.70. Gold smashed through $940 like the Jackson through Hooker's Union army at Chancellorsville, then ran to $954, the next resistance. It couldn't quite clear that mark, but has another chance next week, and a chance to clear $968. Even if this rally is destined to fail at US$1,000 (which I doubt), it's virtually certain to reach US$980. Next week gold might correct, but not lower than $930. In fact, I don't believe we will ever see gold drop below $909 again.

Again this week, the SILVER PRICE rose twice as fast as gold, closing the week at $13.87, up 47.2c for the week and 10.5c for the day (Comex close). Silver has now beaten $13.80 resistance, but I really want to see it close above $14.25 to feel more comfortable. The Grand Resistance silver must beat is $16.50.

I think the danger of $12.00 silver has passed,and the rest of the summer will be spent with silver and gold trading in sometimes frustrating sideways direction, but generally upward. Don't let the rally in stocks distract you. Silver and gold are headed higher.

Big news today is that the Dow in Gold Dollars, to which I pointed y'all last week, broke through G$194 (9.385 oz) resistance and has run to its 200 day moving average. It might stop there, or it might rise as high as G$215 (10.401 oz). For a short time, expect stocks to outperform gold, as long as eight weeks. However, this is a countertrend rally. Since August 2009 the DiG$ has fallen from G$925.42 (44.767 oz) to today's G$197.26 (9.544 oz), or 78.7%. This bear market (of stocks in terms of gold) will continue until the whole Dow costs G$41.34 (2.000 oz) or less, once this little countertrend rally ends.

STOCKS showed great confusion today. Dow rose 23.95 to 9,093.24, S&P rose 2.97 to 979.26, while Nasdaq fell 7.64 to 1,965.96, Nasdaq 100 fell 2.42 to 1,599.06. All the rest of the indices were likewise mixed. Now two paths are possible. First, stocks gasp and fail here, about Dow 9000. Second, stocks reach Dow 9,700, then collapse. Either way, anyone who still owns stocks ought to take this as a rare, God-given opportunity to sell them and put the proceeds into silver and gold. You won't get another chance at these levels.

The US DOLLAR index today closed down another 18 basis points at 78.813. It has lost 67 basis points since last week. Literally it has reached the bottom of its range. If it falls more, then it will fall another 200 basis points or more. Get busy, Nice Government Men! You have a market to manipulate!

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Tuesday, July 21, 2009

Gold Will Run at Least to $990

Gold Price Close Today : 946.60

Change: -1.90 or -0.2%

Silver Price Close Today : 13.473

Change: -14.7 cents or -1.1%

Platinum Price Close Today: 1,171.50

Change: -16.00 or -1.3%

Palladium Price Close Today: 256.50

Change: 2.00 or 0.8%

Gold Silver Ratio Today: 70.26

Change: 0.619 or 0.9%

Dow Industrial: 8,915.94

Change: 67.79 or 0.8%

US Dollar Index: 78.78

Change: -0.05 or -0.1%

The GOLD PRICE burst the top bound of its range ($940) but as yet hasn't been able to burst through $955. Last two days it's trapped between $955 - $945, so our "must beat" close is $955. Chart says that gold will run at least to $990. Will it then burst the bounds of $1,000? Can't say, but if not soon, then later. Gold's MACD turned up 13 July and has a long way to rise. RSI is a little higher, a cautionary sign. All in all, gold has plenty of room to move higher. Today on Comex gold closed $946.60, down $1.90.

The SILVER PRICE was stopped at $13.75 cents. It has left a V-pattern in July's chart, falling from $13.60 to $12.45, then rising back to $13.75 in six days. ΩWhew! Time for a rest. Rest, however, should not drop lower than $13.45 close. Targets in front of us are $13.80 and then $14.00.

Friends, while the summer doldrums are here you'd better stock up on silver and gold. Fall will be neither gentle nor kind. Gird up your loins and get your house in order.

The US DOLLAR INDEX has fallen nearly to its June low at 78.33. The rollover top suggests twill re-visit 77.70, maybe 76. Trading right now at 78.781, down 5 basis points.

STOCKS have risen seven days running. How long can that last? Not much longer. Yet the real question here is, Does this rally to 8,900 form a double top with June, & therefore cap stocks rally, OR will the Dow march further toward 9,700? Regardless stocks should correct in the next couple of days, and once that correction passes, we will see the longer term direction. Dow today rose 67.79 to 8,915.94, and S&P 500 closed 954.58,. Up 3.45.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: -1.90 or -0.2%

Silver Price Close Today : 13.473

Change: -14.7 cents or -1.1%

Platinum Price Close Today: 1,171.50

Change: -16.00 or -1.3%

Palladium Price Close Today: 256.50

Change: 2.00 or 0.8%

Gold Silver Ratio Today: 70.26

Change: 0.619 or 0.9%

Dow Industrial: 8,915.94

Change: 67.79 or 0.8%

US Dollar Index: 78.78

Change: -0.05 or -0.1%

The GOLD PRICE burst the top bound of its range ($940) but as yet hasn't been able to burst through $955. Last two days it's trapped between $955 - $945, so our "must beat" close is $955. Chart says that gold will run at least to $990. Will it then burst the bounds of $1,000? Can't say, but if not soon, then later. Gold's MACD turned up 13 July and has a long way to rise. RSI is a little higher, a cautionary sign. All in all, gold has plenty of room to move higher. Today on Comex gold closed $946.60, down $1.90.

The SILVER PRICE was stopped at $13.75 cents. It has left a V-pattern in July's chart, falling from $13.60 to $12.45, then rising back to $13.75 in six days. ΩWhew! Time for a rest. Rest, however, should not drop lower than $13.45 close. Targets in front of us are $13.80 and then $14.00.

Friends, while the summer doldrums are here you'd better stock up on silver and gold. Fall will be neither gentle nor kind. Gird up your loins and get your house in order.

The US DOLLAR INDEX has fallen nearly to its June low at 78.33. The rollover top suggests twill re-visit 77.70, maybe 76. Trading right now at 78.781, down 5 basis points.

STOCKS have risen seven days running. How long can that last? Not much longer. Yet the real question here is, Does this rally to 8,900 form a double top with June, & therefore cap stocks rally, OR will the Dow march further toward 9,700? Regardless stocks should correct in the next couple of days, and once that correction passes, we will see the longer term direction. Dow today rose 67.79 to 8,915.94, and S&P 500 closed 954.58,. Up 3.45.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Friday, July 17, 2009

This Week the Gold Price Rose 2.7% and the Silver Price Rose 6%

Gold Price Close Today : 937.20

Gold Price Close July 10 : 912.20

Change: 25.00 or 2.7%

Silver Price Close Today : 13.398

Silver Price Close July 10 : 12.637

Change: 76.10 cents or 6.0%

Platinum Price Close Today: 1,173.60

Platinum Price Close July 10 : 1,110.90

Change: 62.700 or 5.6%

Palladium Price Close Today: 249.00

Platinum Price Close July 10 : 232.90

Change: 16.100 or 6.9%

Gold Silver Ratio Today: 69.95

Gold Silver Ratio July 10 : 72.18

Change: -2.23 or -3.1%

Dow Industrial: 8,743.94

Dow Industrial July 10 : 8,146.52

Change: 597.420 or 7.3%

US Dollar Index: 79.478

US Dollar Index July 10 : 80.244

Change: -0.766 or -1.0%

The GOLD PRICE rose US$25 this week to US$937.20. W.o.w. Isn't that interesting, that gold rose exactly twenty-five dollars? That 2.7% rise took gold to the top of its trading range. It still needs to break through $940, then close higher for three days running -- something like $942, then $954, then $968 would be ideal. It's not yet clear and certain whether the gold price is rallying again or merely trading to the top of its range, fated to drop again. However, that's the greatest likelihood, that we've already seen the low and begun the Grand March to $1,000.

Here's what I love about silver. This week the Gold Price rose 2.7% and the Silver Price rose 6%. Yes, the SILVER PRICE really rose 76 cents this week to close at $13.398. To confirm gold's move fully silver must keep on advancing and close above $13.80, then $14.00 at a fairly quick step. Look for that next week. As long as the silver price remains above $13.00 and the gold price above $928, the rally is on track.

Keep on accumulating silver and gold. Buy the dips, or buy both metals on any gold breakout over $940.

Today I'll try to be subtle, although in truth the only gift I have is stating the obvious. Don't laugh at me too hard: in an age of Liars, Intimidation, and Cowards mine is a pretty valuable gift, and fairly rare.

Speaking of obvious, the US DOLLAR INDEX showed its strength this week by falling 76.6 basis points, closing the week below 80 at 79.478. The chart hardly allows any conclusion but a dollar rolling over to the downside, ready to lay down in the grave -- or drop 200 or so basis points anyway. As I have been begging you since spring 2001, get out of US Dollar denominated assets: CDs, bonds, annuities, bank deposits, anything that promises to pay future dollars. Hyperinflation is now a genuine possibility.

STOCKS, on the other hand, staged a miraculous resurrection this week, rising 597.42 to close the week at Dow 8,743.94. S&P added 61.25 points to close at 940.38. This is the Last-Train-Out-Of-Town rally I have been expecting since last fall. It is very strong -- strong enough to fool even the most practiced investors, so don't let it seduce you. Remember Ulysses and the Sirens. This is literally your last chance to get out of stocks and swap the proceeds into silver and gold. After a top around 9,700, look for stocks to break 6,000, unless Bernanke and his Fed Bumblers manage to put the dollar into hyperinflation. Even then, silver and gold would vastly outperform stocks.

The DOW IN GOLD DOLLARS deserves a look. It has once again (thanks to stocks' strength this week) traded up to G$193(9.336 oz). Since April this level has acted like the Escarpment in Tarzan movies, throwing back all attempts to scale it. It the DiG$ breaks G$193, it will run to G$215 (10.401 oz) or to the 200 day moving average G$201 (9.722 oz). That brief outperformance of gold would add fuel to the stock-rally frenzy, but keep on reminding yourself that this is merely a typical bear market rally, sudden, sharp, and short. Don't let stocks sucker you!

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Gold Price Close July 10 : 912.20

Change: 25.00 or 2.7%

Silver Price Close Today : 13.398

Silver Price Close July 10 : 12.637

Change: 76.10 cents or 6.0%

Platinum Price Close Today: 1,173.60

Platinum Price Close July 10 : 1,110.90

Change: 62.700 or 5.6%

Palladium Price Close Today: 249.00

Platinum Price Close July 10 : 232.90

Change: 16.100 or 6.9%

Gold Silver Ratio Today: 69.95

Gold Silver Ratio July 10 : 72.18

Change: -2.23 or -3.1%

Dow Industrial: 8,743.94

Dow Industrial July 10 : 8,146.52

Change: 597.420 or 7.3%

US Dollar Index: 79.478

US Dollar Index July 10 : 80.244

Change: -0.766 or -1.0%

The GOLD PRICE rose US$25 this week to US$937.20. W.o.w. Isn't that interesting, that gold rose exactly twenty-five dollars? That 2.7% rise took gold to the top of its trading range. It still needs to break through $940, then close higher for three days running -- something like $942, then $954, then $968 would be ideal. It's not yet clear and certain whether the gold price is rallying again or merely trading to the top of its range, fated to drop again. However, that's the greatest likelihood, that we've already seen the low and begun the Grand March to $1,000.

Here's what I love about silver. This week the Gold Price rose 2.7% and the Silver Price rose 6%. Yes, the SILVER PRICE really rose 76 cents this week to close at $13.398. To confirm gold's move fully silver must keep on advancing and close above $13.80, then $14.00 at a fairly quick step. Look for that next week. As long as the silver price remains above $13.00 and the gold price above $928, the rally is on track.

Keep on accumulating silver and gold. Buy the dips, or buy both metals on any gold breakout over $940.

Today I'll try to be subtle, although in truth the only gift I have is stating the obvious. Don't laugh at me too hard: in an age of Liars, Intimidation, and Cowards mine is a pretty valuable gift, and fairly rare.

Speaking of obvious, the US DOLLAR INDEX showed its strength this week by falling 76.6 basis points, closing the week below 80 at 79.478. The chart hardly allows any conclusion but a dollar rolling over to the downside, ready to lay down in the grave -- or drop 200 or so basis points anyway. As I have been begging you since spring 2001, get out of US Dollar denominated assets: CDs, bonds, annuities, bank deposits, anything that promises to pay future dollars. Hyperinflation is now a genuine possibility.

STOCKS, on the other hand, staged a miraculous resurrection this week, rising 597.42 to close the week at Dow 8,743.94. S&P added 61.25 points to close at 940.38. This is the Last-Train-Out-Of-Town rally I have been expecting since last fall. It is very strong -- strong enough to fool even the most practiced investors, so don't let it seduce you. Remember Ulysses and the Sirens. This is literally your last chance to get out of stocks and swap the proceeds into silver and gold. After a top around 9,700, look for stocks to break 6,000, unless Bernanke and his Fed Bumblers manage to put the dollar into hyperinflation. Even then, silver and gold would vastly outperform stocks.

The DOW IN GOLD DOLLARS deserves a look. It has once again (thanks to stocks' strength this week) traded up to G$193(9.336 oz). Since April this level has acted like the Escarpment in Tarzan movies, throwing back all attempts to scale it. It the DiG$ breaks G$193, it will run to G$215 (10.401 oz) or to the 200 day moving average G$201 (9.722 oz). That brief outperformance of gold would add fuel to the stock-rally frenzy, but keep on reminding yourself that this is merely a typical bear market rally, sudden, sharp, and short. Don't let stocks sucker you!

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Thursday, July 16, 2009

Keep on Buying Silver and Gold. Much Higher Prices Coming Soon

Gold Price Close Today : 935.10

Change: -4.00 or -0.4%

Silver Price Close Today : 13.230

Change: 2.7 cents or 0.2%

Gold Silver Ratio Today: 70.68

Change: -0.448 or -0.6%

Dow Industrial: 8,711.82

Change: 95.61 or 1.1%

US Dollar Index: 79.214

Change: -0.22 or -0.3%

As suspected, the GOLD PRICE backed off a little today before leaping that $940 hurdle. On Comex it closed down $4 at US$935.10. As long as it closes above $928, it's just noise. Look for a leap over US$940 tomorrow. Can US$1,000 gold be far behind?

The SILVER PRICE rose 2.7 cents to close at $13.23 on Comex. This is nice, sweet, but not meaningful. Silver must clear $13.80, soon, and I doubt not that it will.

Keep on buying silver & gold. Much higher prices coming soon. Get out of stocks and US Dollar denominated investments.

US DOLLAR INDEX kept on falling today, down another 21.6 basis points to 79.213. By now the Nice Government Men charged with manipulating the markets must be in a real bind. If they raise the dollar's value, it crashes stocks. If they lower the dollar's value, it sucks confidence away from the already wobbly dollar. What's a fascist apparatchik to do? Favour one for a while, and then the other. Right now it's stocks' turn. A close below 79 takes the dollar index down 200 or so basis points. Be watching.

STOCKS rose again today, the Dow by 95.61 to 8,711.82 and the S&P500 by 8 to 940.74. This will probably be the last party rebound rally I was expecting earlier in the year, and will run to 9,000 or 9,700. Wake up! This is y'all's last chance to sell stocks and put the proceeds into silver and gold. Better grab it.

For those who wondered but didn't write, a "shoat" is a young weaned pig, around here 25 - 80 lb.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: -4.00 or -0.4%

Silver Price Close Today : 13.230

Change: 2.7 cents or 0.2%

Gold Silver Ratio Today: 70.68

Change: -0.448 or -0.6%

Dow Industrial: 8,711.82

Change: 95.61 or 1.1%

US Dollar Index: 79.214

Change: -0.22 or -0.3%

As suspected, the GOLD PRICE backed off a little today before leaping that $940 hurdle. On Comex it closed down $4 at US$935.10. As long as it closes above $928, it's just noise. Look for a leap over US$940 tomorrow. Can US$1,000 gold be far behind?

The SILVER PRICE rose 2.7 cents to close at $13.23 on Comex. This is nice, sweet, but not meaningful. Silver must clear $13.80, soon, and I doubt not that it will.

Keep on buying silver & gold. Much higher prices coming soon. Get out of stocks and US Dollar denominated investments.

US DOLLAR INDEX kept on falling today, down another 21.6 basis points to 79.213. By now the Nice Government Men charged with manipulating the markets must be in a real bind. If they raise the dollar's value, it crashes stocks. If they lower the dollar's value, it sucks confidence away from the already wobbly dollar. What's a fascist apparatchik to do? Favour one for a while, and then the other. Right now it's stocks' turn. A close below 79 takes the dollar index down 200 or so basis points. Be watching.

STOCKS rose again today, the Dow by 95.61 to 8,711.82 and the S&P500 by 8 to 940.74. This will probably be the last party rebound rally I was expecting earlier in the year, and will run to 9,000 or 9,700. Wake up! This is y'all's last chance to sell stocks and put the proceeds into silver and gold. Better grab it.

For those who wondered but didn't write, a "shoat" is a young weaned pig, around here 25 - 80 lb.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Wednesday, July 15, 2009

Today Half the World Bought Gold

Gold Price Close Today : 939.10

Change: 16.60 or 1.8%

Silver Price Close Today : 13.203

Change: 34.8 cents or 2.7%

Gold Silver Ratio Today: 71.13

Change: -0.634 or -0.9%

Dow Industrial: 8,579.71

Change: 185.16 or 2.3%

US Dollar Index: 79.34

Change: -0.68 or -0.9%

Sorry I missed sending y'all a commentary yesterday, but I unexpectedly had to accompany my son to Chattanooga with a load of shoats. I didn't get back in time to send a commentary.

It really didn't matter much, anyway, since I had told y'all my outlook on Monday, and that proved enough. I said that as long as the GOLD PRICE didn't close beneath $918, we had probably seen the bottom. Nothing much happened yesterday (gold rose 30 cents, silver rose 7 cents), but today half the world bought gold. It rose $16.60 to close at $939.10 on Comex, while the SILVER PRICE climbed 34.8 cents to end at $13.203.

The gold price now needs to close above $940.10, then jump over $954. Otherwise, gold has simply teased us with yet another rise within a trading range. However, this move feels very strong. Silver confirmed today's gold rise with a respectable 34.8 cent rise, but still needs to confirm a gold breakout by closing over $13.80.

Greatest likelihood here is that silver and gold prices continue to rally. However, gold needs to climb above that $940.10 point to confirm. Gold may be slapped back tomorrow, but should hold above $928, then attack $940.10 again. But whether gold continues to rally, or zigs and zags first, we've probably seen the bottom. In no way should you be short gold or silver here, and if you have been planning to buy, better get about it.

STOCKS rallied today on US DOLLAR weakness. Seems markets love a fainting dollar. Dow rose 220.22 to 8,579.71, and S&P500 rose 23.2 to 929.06. This suddenly breaks stocks out of the downward trading channel, and points to a rise to 8,800 or above.

The US DOLLAR INDEX dropped below 80 again today, down 70 basis points to 79.342. US dollar index is rolling over to the downside. A single close below 79 will likely suffice to send the dollar falling another 200 basis points.

Have y'all noticed that California banks have said NO to accepting the state's IOUs? Would Washington bail out the banks for $8 trillion and not bail out California for a cheapskate $26 billion? Don't count on Washington letting California drown. What's a central bank, for, anyway, but to print money for your friends when they're down? Does this mean more inflation? Can a duck swim? Is a pig's little bottom pork? Does Goldman Sachs run D.C.?

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: 16.60 or 1.8%

Silver Price Close Today : 13.203

Change: 34.8 cents or 2.7%

Gold Silver Ratio Today: 71.13

Change: -0.634 or -0.9%

Dow Industrial: 8,579.71

Change: 185.16 or 2.3%

US Dollar Index: 79.34

Change: -0.68 or -0.9%

Sorry I missed sending y'all a commentary yesterday, but I unexpectedly had to accompany my son to Chattanooga with a load of shoats. I didn't get back in time to send a commentary.

It really didn't matter much, anyway, since I had told y'all my outlook on Monday, and that proved enough. I said that as long as the GOLD PRICE didn't close beneath $918, we had probably seen the bottom. Nothing much happened yesterday (gold rose 30 cents, silver rose 7 cents), but today half the world bought gold. It rose $16.60 to close at $939.10 on Comex, while the SILVER PRICE climbed 34.8 cents to end at $13.203.

The gold price now needs to close above $940.10, then jump over $954. Otherwise, gold has simply teased us with yet another rise within a trading range. However, this move feels very strong. Silver confirmed today's gold rise with a respectable 34.8 cent rise, but still needs to confirm a gold breakout by closing over $13.80.

Greatest likelihood here is that silver and gold prices continue to rally. However, gold needs to climb above that $940.10 point to confirm. Gold may be slapped back tomorrow, but should hold above $928, then attack $940.10 again. But whether gold continues to rally, or zigs and zags first, we've probably seen the bottom. In no way should you be short gold or silver here, and if you have been planning to buy, better get about it.

STOCKS rallied today on US DOLLAR weakness. Seems markets love a fainting dollar. Dow rose 220.22 to 8,579.71, and S&P500 rose 23.2 to 929.06. This suddenly breaks stocks out of the downward trading channel, and points to a rise to 8,800 or above.

The US DOLLAR INDEX dropped below 80 again today, down 70 basis points to 79.342. US dollar index is rolling over to the downside. A single close below 79 will likely suffice to send the dollar falling another 200 basis points.

Have y'all noticed that California banks have said NO to accepting the state's IOUs? Would Washington bail out the banks for $8 trillion and not bail out California for a cheapskate $26 billion? Don't count on Washington letting California drown. What's a central bank, for, anyway, but to print money for your friends when they're down? Does this mean more inflation? Can a duck swim? Is a pig's little bottom pork? Does Goldman Sachs run D.C.?

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Monday, July 13, 2009

Now Appears that the Gold Price Bottomed at $906

Gold Price Close Today : 922.20

Change: 10.00 or 1.1%

Silver Price Close Today : 12.785

Change: 14.8 cents or 1.2%

Gold Silver Ratio Today: 72.13

Change: -0.053 or -0.1%

Dow Industrial: 8,331.68

Change: 185.16 or 2.3%

US Dollar Index: 80.05

Change: -0.11 or -0.1%

It now appears that the gold price bottomed at 906 last Wednesday. Today's gold price low was 908, then it made a much higher close above the previous low at 918. Unless the gold price closes tomorrow below 918, we have probably seen the bottom.

The silver price made the first half of a key reversal today with a new low at 12.43 and a higher close at 12.785 (up 14.8 cents). More than that, it made a double bottom during today's trading. The silver price still needs to put in the second half of the key reversal tomorrow, that is, a close above today's. Assuming we see that, it's a good bet we've seen silver's low.

While lower prices for silver and gold are still possible, the gold price would have to break 906 and the silver price 12.43 to get there. I'm buying here.

Even rallying today to Dow 8,331.68 (up 185.16) and S&P500 901.05 (up 21.92), stocks remain locked in a downtrending channel. The Dow's 200 DMA stands above today's close at 8,357. As yet, nothing about this move suggests it is anything more than daily noise in a downtrend.

The US Dollar index knifed its friends in the back again today, falling 11.2 basis points to 80.46. At least it managed to hold on above 80. Without a breakout above 81.50, the dollar is going nowhere.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: 10.00 or 1.1%

Silver Price Close Today : 12.785

Change: 14.8 cents or 1.2%

Gold Silver Ratio Today: 72.13

Change: -0.053 or -0.1%

Dow Industrial: 8,331.68

Change: 185.16 or 2.3%

US Dollar Index: 80.05

Change: -0.11 or -0.1%

It now appears that the gold price bottomed at 906 last Wednesday. Today's gold price low was 908, then it made a much higher close above the previous low at 918. Unless the gold price closes tomorrow below 918, we have probably seen the bottom.

The silver price made the first half of a key reversal today with a new low at 12.43 and a higher close at 12.785 (up 14.8 cents). More than that, it made a double bottom during today's trading. The silver price still needs to put in the second half of the key reversal tomorrow, that is, a close above today's. Assuming we see that, it's a good bet we've seen silver's low.

While lower prices for silver and gold are still possible, the gold price would have to break 906 and the silver price 12.43 to get there. I'm buying here.

Even rallying today to Dow 8,331.68 (up 185.16) and S&P500 901.05 (up 21.92), stocks remain locked in a downtrending channel. The Dow's 200 DMA stands above today's close at 8,357. As yet, nothing about this move suggests it is anything more than daily noise in a downtrend.

The US Dollar index knifed its friends in the back again today, falling 11.2 basis points to 80.46. At least it managed to hold on above 80. Without a breakout above 81.50, the dollar is going nowhere.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Friday, July 10, 2009

Expect a Couple More Weeks of Sidewise to Lower Gold Prices

Gold Price Close Today : 912.20

Gold Price Close 2 July: 930.70

Change: -18.50 or -2.0%

Silver Price Close Today : 12.637

Silver Price Close 2 July: 13.394

Change: -75.70 cents or -5.7%

Gold Silver Ratio Today: 72.18

Gold Silver Ratio 2 July: 69.49

Change: 2.70 or 3.9%

Dow Industrial: 8,146.52

Dow 2 July: 8,280.74

Change: -134.220 or -1.6%

US Dollar Index: 80.244

US Dollar 2 July: 80.284

Change: -0.040 or 0.0%

It was a rough week for everything. The US DOLLAR INDEX closed today at 80.244, up 30.9 basis points from yesterday, but down 4 basis points for the week. The dollar remains range bound, between 79.50 and 81.00. There must be a huge number of people ready to short the dollar every time it nears 81. I can't seen any reason to expect strength out of the dollar any time soon, but a close above 81 would prove me wrong.

STOCKS are locked in a downtrend headed for 7,800 over the next four weeks. Dow today closed at 8,146.52, down 36.65, and S&P500 closed at 879.13, down 3.55 basis points.

What makes me curious is the DOW IN GOLD DOLLARS. It keeps hanging around G$185 (8.95 oz). Dow falls, then the dollar seems to fall just enough to keep the Dow in Gold Dollars around G$185. Odd. I don't think stocks are about to scoot off and leave gold standing still, but it provokes thought to see the DiG$ failing to move lower as stocks move lower.

Likewise another puzzler is the GOLD/SILVER RATIO. It has now reached a relatively high level, just above 72. Time to trade gold for silver. I favour an allotment of 70% silver to 30% gold, based on this high ratio. Here's your chance to adjust your portfolio to a greater silver share.

The gold price closed today down 3.70 at US$912.20. The gold price does not appear ready to turn around, so expect a couple more weeks of sidewise to lower prices. Since gold is leading metals right now, silver will merely tag along. But even as these words drip off my fingertips. I hesitate, remember the instability in the world today. Tomorrow we wake up and anything could happen, literally anything. That's one reason you must go ahead and establish your silver and gold position now.

Looking at gold's week, it bottomed Wednesday (intraday)just below 906. So long as gold closeth not below 906, its correction has been completed. Today's low (907.24) shows that the gold price has yet a fight in front of it.

Upside the gold price needs to clear 930, then 942 quickly. If it breaks 906-900, it could fall as low as 865. More likely is a quick plunge to 890 support, or even to the 200 DMA at 877.

The silver price dropped sharply again today, down 28.7 cents to 12.6370. On its weekly chart the silver price has broken its 200 DMA (12.93). The RSI and MACD are not yet ready to turn around, but the same indicators on silver's daily chart appear likely to turn up.

Who knows, the silver price may have bottomed today when it made a little double bottom at 12.52. To prove the correction is past, silver must rise and close above 13.75. Otherwise it will trade sidewise to lower, maybe dropping to the 200 DMA (now 12.23) or even to 12.00.

It's a bull market. The trend will kindly cover a multitude of timing mistakes. Keep buying on dips. Don't let current weakness take your eyes off the strong long term

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Gold Price Close 2 July: 930.70

Change: -18.50 or -2.0%

Silver Price Close Today : 12.637

Silver Price Close 2 July: 13.394

Change: -75.70 cents or -5.7%

Gold Silver Ratio Today: 72.18

Gold Silver Ratio 2 July: 69.49

Change: 2.70 or 3.9%

Dow Industrial: 8,146.52

Dow 2 July: 8,280.74

Change: -134.220 or -1.6%

US Dollar Index: 80.244

US Dollar 2 July: 80.284

Change: -0.040 or 0.0%

It was a rough week for everything. The US DOLLAR INDEX closed today at 80.244, up 30.9 basis points from yesterday, but down 4 basis points for the week. The dollar remains range bound, between 79.50 and 81.00. There must be a huge number of people ready to short the dollar every time it nears 81. I can't seen any reason to expect strength out of the dollar any time soon, but a close above 81 would prove me wrong.

STOCKS are locked in a downtrend headed for 7,800 over the next four weeks. Dow today closed at 8,146.52, down 36.65, and S&P500 closed at 879.13, down 3.55 basis points.

What makes me curious is the DOW IN GOLD DOLLARS. It keeps hanging around G$185 (8.95 oz). Dow falls, then the dollar seems to fall just enough to keep the Dow in Gold Dollars around G$185. Odd. I don't think stocks are about to scoot off and leave gold standing still, but it provokes thought to see the DiG$ failing to move lower as stocks move lower.

Likewise another puzzler is the GOLD/SILVER RATIO. It has now reached a relatively high level, just above 72. Time to trade gold for silver. I favour an allotment of 70% silver to 30% gold, based on this high ratio. Here's your chance to adjust your portfolio to a greater silver share.

The gold price closed today down 3.70 at US$912.20. The gold price does not appear ready to turn around, so expect a couple more weeks of sidewise to lower prices. Since gold is leading metals right now, silver will merely tag along. But even as these words drip off my fingertips. I hesitate, remember the instability in the world today. Tomorrow we wake up and anything could happen, literally anything. That's one reason you must go ahead and establish your silver and gold position now.

Looking at gold's week, it bottomed Wednesday (intraday)just below 906. So long as gold closeth not below 906, its correction has been completed. Today's low (907.24) shows that the gold price has yet a fight in front of it.

Upside the gold price needs to clear 930, then 942 quickly. If it breaks 906-900, it could fall as low as 865. More likely is a quick plunge to 890 support, or even to the 200 DMA at 877.

The silver price dropped sharply again today, down 28.7 cents to 12.6370. On its weekly chart the silver price has broken its 200 DMA (12.93). The RSI and MACD are not yet ready to turn around, but the same indicators on silver's daily chart appear likely to turn up.

Who knows, the silver price may have bottomed today when it made a little double bottom at 12.52. To prove the correction is past, silver must rise and close above 13.75. Otherwise it will trade sidewise to lower, maybe dropping to the 200 DMA (now 12.23) or even to 12.00.

It's a bull market. The trend will kindly cover a multitude of timing mistakes. Keep buying on dips. Don't let current weakness take your eyes off the strong long term

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Thursday, July 09, 2009

Silver and Gold Prices May be Struggling Here in July, but by September They Will be Rallying Again

Gold Price Close Today : 915.90

Change: 6.90 or 0.8%

Silver Price Close Today : 12.924

Change: 8.3 cents or 0.6%

Gold Silver Ratio: 70.87

Change: 0.079 or 0.1%

Dow Industrial: 8,174.71

Change: -3.40 or 0.0%

US Dollar Index: 79.85

Change: -0.78 or -1.0%

Vermont and New Hampshire are breathtaking. My son and I returned late last night from three day's hunting cows. Well, not hunting with a gun, but searching for a Scotch Highland bull to replace our Pilgram who died. And find one we did, and four handsome heifers besides. Father of this little bull had a rack of horns seven feet wide. I wish I could send y'all a picture.

In my absence the US dollar index rises for three days, gets a whiff of 81, and collapses. The dollar is trapped between 79.40 and 81. The chart looks like a broadening top, which always breaks down, although it nags you to death waiting for it. Today the dollar index dropped at huge 78 basis points to close at 79.852.

Stocks are confused today, with most indices barely rising and the Dow barely falling 3.4 to 8,174.71. S&P500 closed up 2.42 at 881.98. Given the downtrend, stocks should reach 7,800 in two weeks.

The silver price, on no particular cause except the fullness of time, hit my $13.00 target and sank a bit beneath it. Yesterday's close was 12.8410, and that might mark the low close for this correction. If not we are looking at the 200 DMA and $12.23.

Add to this muddle of messages the premium on US 90% silver coin, which at wholesale has risen from 25 cents an ounce under spot on 1 July to 15 cents over spot today. That's a large move, and I've come to expect the 90% coin premium to rise -- stubbornly -- when a silver bottom has been hit. Sellers just disappear while buyers clamour for more, and that premium must rise. Sign that a bottom is near.

The gold price hit support at 906 yesterday. If 906-900 fails, then expect a quick fall toward 865, the last low. However, as strong as gold is, it might stop at the 200 DMA (877.11) or anywhere along the way, including support at 889.

I look at the chart and other indicators, and begin to think this correction may last longer than I had originally thought. On the other hand, Tuesday's low could be a double bottom with the low on 23 June (intraday low as 913.20).

Think long term, long term. Silver and gold prices may be struggling here in July, but by September they will be rallying again. Don't miss a single opportunity to buy more silver and gold on every decline. Meanwhile, the market will soon tell us the outcome of this short term trend, either by closing below 900 or rising above 930.

On this day in 1991 after a 4-1/2 month trial and 18 month pre-trial and four year investigation, the jury in our federal trial for conspiracy and wilful failure to file income tax returns came back with a NOT GUILTY verdict for all 16 defendants. Because I had opened a gold and silver bank, the IRS and Federal Government claimed that I was engaged in a conspiracy to delay or defeat the IRS. It was merely one more example of the US government's war on silver and gold money, as the enforcer of the banks' monopoly. Not one of us had done anything wrong, or illegal.

Psalm 27 says, "Though an host of men were laid against me, yet shall not my heart be afraid; and though there rose up war against me, yet will I put my trust in [the Lord]." The almighty federal government came down on us to gobble us up, wives and husbands. They spent 4 years investigation, maybe $20 million, and another $2 million on a trial. They had all the guns and all the money and endless lies. In our defense, we had only the Lord God on our side. Let those who think his arm cannot save behold, and cover their mouths with their hands. The Lord lives, and covers himself with glory, and never fails those who call on him.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: 6.90 or 0.8%

Silver Price Close Today : 12.924

Change: 8.3 cents or 0.6%

Gold Silver Ratio: 70.87

Change: 0.079 or 0.1%

Dow Industrial: 8,174.71

Change: -3.40 or 0.0%

US Dollar Index: 79.85

Change: -0.78 or -1.0%

Vermont and New Hampshire are breathtaking. My son and I returned late last night from three day's hunting cows. Well, not hunting with a gun, but searching for a Scotch Highland bull to replace our Pilgram who died. And find one we did, and four handsome heifers besides. Father of this little bull had a rack of horns seven feet wide. I wish I could send y'all a picture.

In my absence the US dollar index rises for three days, gets a whiff of 81, and collapses. The dollar is trapped between 79.40 and 81. The chart looks like a broadening top, which always breaks down, although it nags you to death waiting for it. Today the dollar index dropped at huge 78 basis points to close at 79.852.

Stocks are confused today, with most indices barely rising and the Dow barely falling 3.4 to 8,174.71. S&P500 closed up 2.42 at 881.98. Given the downtrend, stocks should reach 7,800 in two weeks.

The silver price, on no particular cause except the fullness of time, hit my $13.00 target and sank a bit beneath it. Yesterday's close was 12.8410, and that might mark the low close for this correction. If not we are looking at the 200 DMA and $12.23.

Add to this muddle of messages the premium on US 90% silver coin, which at wholesale has risen from 25 cents an ounce under spot on 1 July to 15 cents over spot today. That's a large move, and I've come to expect the 90% coin premium to rise -- stubbornly -- when a silver bottom has been hit. Sellers just disappear while buyers clamour for more, and that premium must rise. Sign that a bottom is near.

The gold price hit support at 906 yesterday. If 906-900 fails, then expect a quick fall toward 865, the last low. However, as strong as gold is, it might stop at the 200 DMA (877.11) or anywhere along the way, including support at 889.

I look at the chart and other indicators, and begin to think this correction may last longer than I had originally thought. On the other hand, Tuesday's low could be a double bottom with the low on 23 June (intraday low as 913.20).

Think long term, long term. Silver and gold prices may be struggling here in July, but by September they will be rallying again. Don't miss a single opportunity to buy more silver and gold on every decline. Meanwhile, the market will soon tell us the outcome of this short term trend, either by closing below 900 or rising above 930.

On this day in 1991 after a 4-1/2 month trial and 18 month pre-trial and four year investigation, the jury in our federal trial for conspiracy and wilful failure to file income tax returns came back with a NOT GUILTY verdict for all 16 defendants. Because I had opened a gold and silver bank, the IRS and Federal Government claimed that I was engaged in a conspiracy to delay or defeat the IRS. It was merely one more example of the US government's war on silver and gold money, as the enforcer of the banks' monopoly. Not one of us had done anything wrong, or illegal.