Gold Price Close Today : 927.10

Change: -13.30 or -1.5%

Silver Price Close Today : 13.574

Change: -37.3 cents or -2.7%

Gold Silver Ratio: 68.30

Change: 2.780 or 4.2%

Dow Industrial: 8,447.00

Change: 82.38 or 1.0%

US Dollar Index: 80.18

Change: 0.27 or 0.3%

The US DOLLAR, today's little rise by 27 basis points to 80.178 notwithstanding, has rolled over to the downside, and must now close above 80.75 to turn up. Maybe it will tomorrow, but probably without much enthusiasm.

STOCKS didn't get close enough to smell Dow 8,600 before they turned and fled. Now the Dow stands under its 200 day moving average (8,464.92 today), which in a bear market usually signals a downturn. The Dow should see 8,200 before it sees 8,600.

The SILVER PRICE slipped below its 50 DMA (14.06 cents) today to close on Comex at 13.574, down 37.3 cents. If the silver price cannot defend the line around 13.50 tomorrow, then 'twill drop to 13.00. If the silver price is ever going to drop further it will happen tomorrow. If it holds on here, well, my, that will be strong indeed.

The GOLD PRICE also dipped below its 50 DMA (930.35) and closed on Comex at US$927.10, down 13.30. Several different plots might unroll: (1) The gold price might stop right here, or (2) the gold price might return to its 918.00 previous low and make a double bottom there, or (3) the gold price could drop through 918 to 900 or lower.

If all this sounds bearish coming from my lips, remember that time is running out for lower gold and silver prices. Besides, I hope they do go down and give all of y'all one last chance to buy silver and gold on the cheap, before gold blows through US$1,000 next fall, holding silver's hand.

Tuesday is supposed to be my day off, but I worked bees today with my son, Wright. I'll never get used to opening up a hive of bees while they calmly go about their business. Well, those sweet yellow Italian bees do that. Those black Caucasian bees will eat you alive, and sting you through a bee suit. Is the honey worth the trouble? Are you kidding? Just one single time taste sourwood honey right out of the hive, and you'll know.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Tuesday, June 30, 2009

Monday, June 29, 2009

Fall Will be a Nightmare for the US Dollar, and High Cotton for Silver and Gold

Gold Price Close Today : 940.40

Change: -0.30 or -0.0%

Silver Price Close Today : 13.947

Change: -18 cents or -1.3%

Gold Silver Ratio: 67.43

Change: 0.838 or 1.3%

Dow Industrial: 8,529.38

Change: 90.99 or 1.1%

US Dollar Index: 79.90

Change: -0.04 or -0.1%

Most markets went sideways today, numbed by traders cleaning their positions before the 4 July holiday.

Both silver and gold prices closed down today on Comex. The gold price dropped 30 cents to 940.40 while the silver price closed down 18 cents at 13.947. While the gold price is holding on at the high end of its trading range, lower closes by both, even though gold's loss was only 30 cents, just doesn't look good. Then again, the week of July 4th is not the time to expect any colossal moves. Somnolence is more likely.

Keep on buying silver and gold on every dip. July brings a possible bankruptcy (practical if not declared) to California, which won't exactly cheer bond markets. Fall will be a nightmare for the US dollar, and high cotton for silver and gold.

The US DOLLAR INDEX barely moved today, down 4 basis points at 79.899. Standing under 80 looks weak.

STOCKS rose 90.99 today to close at 8529.38, a little above the 200 DMA (8,479.80). Any rise will probably hit the brick wall at 8,600.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: -0.30 or -0.0%

Silver Price Close Today : 13.947

Change: -18 cents or -1.3%

Gold Silver Ratio: 67.43

Change: 0.838 or 1.3%

Dow Industrial: 8,529.38

Change: 90.99 or 1.1%

US Dollar Index: 79.90

Change: -0.04 or -0.1%

Most markets went sideways today, numbed by traders cleaning their positions before the 4 July holiday.

Both silver and gold prices closed down today on Comex. The gold price dropped 30 cents to 940.40 while the silver price closed down 18 cents at 13.947. While the gold price is holding on at the high end of its trading range, lower closes by both, even though gold's loss was only 30 cents, just doesn't look good. Then again, the week of July 4th is not the time to expect any colossal moves. Somnolence is more likely.

Keep on buying silver and gold on every dip. July brings a possible bankruptcy (practical if not declared) to California, which won't exactly cheer bond markets. Fall will be a nightmare for the US dollar, and high cotton for silver and gold.

The US DOLLAR INDEX barely moved today, down 4 basis points at 79.899. Standing under 80 looks weak.

STOCKS rose 90.99 today to close at 8529.38, a little above the 200 DMA (8,479.80). Any rise will probably hit the brick wall at 8,600.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Friday, June 26, 2009

The Gold Price is About to Move Higher, and Drag the Silver Price with it

Gold Price Close Today : 940.70

Gold Price Close 19th of June: 935.6

Change: 5.10 or 0.5%

Silver Price Close Today : 14.128

Silver Price Close 19th of June: 14.189

Change: -6.10 cents or -0.4%

Gold Silver Ratio: 66.58

Gold Silver Ratio 19th of June: 65.94

Change: 0.65 or 1.0%

Dow Industrial: 8,438.39

Dow Industrial 19th of June: 8,536.03

Change: -97.640 or -1.1%

US Dollar Index: 79.83

US Dollar Index 19th of June: 80.268

Change: -0.440 or -0.5%

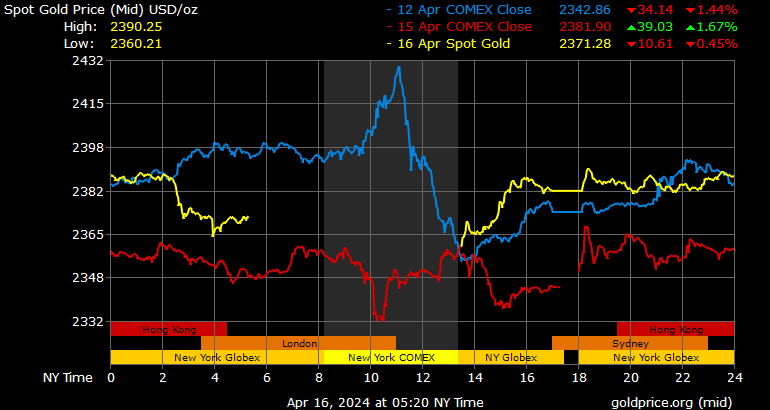

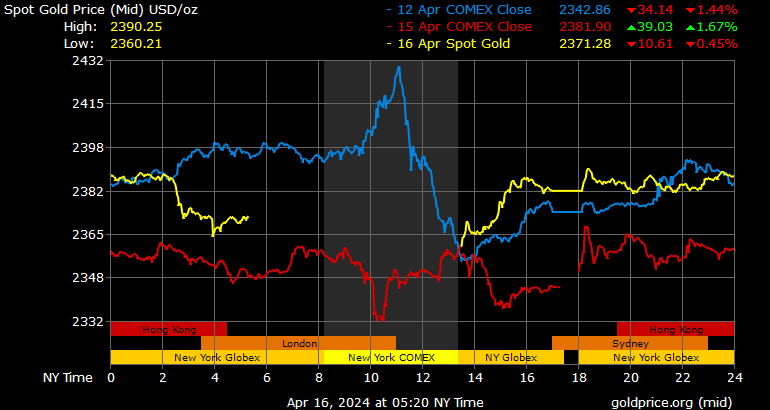

The chart above brightly illustrates why you ought to check WEEKLY charts as well as daily. Think about all the back-and-forth, the tug-and-pull, the blowing and puffing this week -- for what? After all is said and done, the gold price stands five bucks higher, the silver price has fallen a silly six cents, the dollar has fizzled, and stocks have fallen 100 points. In other words, nothing much happened, or else it turned out dead contrary to what you expected during the week.

Since the dollar hit that high on 15 June at 81.085,it has established a firm DOWN trend. Today the dollar ended up at 79.828, down 44 more basis points. If it falls below 79.60 on Monday, then the sharks will smell the blood in the water and the dollar will drop another 100, maybe 150 basis points. Also, I hope the last two weeks' trading has demonstrated to y'all that the idea that gold is tied to the dollar is hogwash. Gold's moves have not been proportional to the dollars, and some days they move the same direction. The Dollar is one driver of gold, but not the only one.

After a rough week when it appeared the gold price would extend its correction down to US$900, it stopped at US$918 and rose to close the week at US$940.70 (Comex), up $5.10 from the week before! Expect an attack on the gold price on Monday, but if the gold price can hold on to US$930 next week, then the low is behind us.

The SILVER PRICE, as always more volatile than the GOLD PRICE, took a greater wound from this week's attack. It closed up today 12.3 cents on the day, but still ended the week down 6.1 cents at $14.12.(Yesterday's commentary had the wrong price, by the way. The silver price closed at $14.00 cents, not $14.05 cents.) Right now, silver is following gold, and y'all shouldn't expect that to change any time soon. At stake here for the Nice Government Men is keeping the gold price away from US$1,000. However, gold is tugging at the leash so hard it might reach US$1,000 before the fall, unseasonal as that might be.

On the other hand, gold's strength might evaporate on Monday and we'd be left with a summer correction to fill out, and lower prices. Right now, my instincts tell me the gold price is about to move higher, and drag the silver price with it.

STOCKS dropped today 34.01 to end at 8,438.39 (S&P500 fell 1.36 to 918.90). With all the nutty projects and changes coming out of Washington, how do they expect stocks ever to rise? Stocks hate uncertainty. Meanwhile, the government is changing all the rules, day by day. Worse, all these changes place permanent drags on the economy, new costs and charges that will continue to pull it underwater long after the current crop of goofs has left DC. If I had planned to de-industrialize the US and gut its economy, I couldn't have done a better job than the US government has done since 1945. Makes you wonder whose side they are on. Anyhow, stocks will fall again next week, and probably will hit 7,800 before this particular downtrend ends.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Gold Price Close 19th of June: 935.6

Change: 5.10 or 0.5%

Silver Price Close Today : 14.128

Silver Price Close 19th of June: 14.189

Change: -6.10 cents or -0.4%

Gold Silver Ratio: 66.58

Gold Silver Ratio 19th of June: 65.94

Change: 0.65 or 1.0%

Dow Industrial: 8,438.39

Dow Industrial 19th of June: 8,536.03

Change: -97.640 or -1.1%

US Dollar Index: 79.83

US Dollar Index 19th of June: 80.268

Change: -0.440 or -0.5%

The chart above brightly illustrates why you ought to check WEEKLY charts as well as daily. Think about all the back-and-forth, the tug-and-pull, the blowing and puffing this week -- for what? After all is said and done, the gold price stands five bucks higher, the silver price has fallen a silly six cents, the dollar has fizzled, and stocks have fallen 100 points. In other words, nothing much happened, or else it turned out dead contrary to what you expected during the week.

Since the dollar hit that high on 15 June at 81.085,it has established a firm DOWN trend. Today the dollar ended up at 79.828, down 44 more basis points. If it falls below 79.60 on Monday, then the sharks will smell the blood in the water and the dollar will drop another 100, maybe 150 basis points. Also, I hope the last two weeks' trading has demonstrated to y'all that the idea that gold is tied to the dollar is hogwash. Gold's moves have not been proportional to the dollars, and some days they move the same direction. The Dollar is one driver of gold, but not the only one.

After a rough week when it appeared the gold price would extend its correction down to US$900, it stopped at US$918 and rose to close the week at US$940.70 (Comex), up $5.10 from the week before! Expect an attack on the gold price on Monday, but if the gold price can hold on to US$930 next week, then the low is behind us.

The SILVER PRICE, as always more volatile than the GOLD PRICE, took a greater wound from this week's attack. It closed up today 12.3 cents on the day, but still ended the week down 6.1 cents at $14.12.(Yesterday's commentary had the wrong price, by the way. The silver price closed at $14.00 cents, not $14.05 cents.) Right now, silver is following gold, and y'all shouldn't expect that to change any time soon. At stake here for the Nice Government Men is keeping the gold price away from US$1,000. However, gold is tugging at the leash so hard it might reach US$1,000 before the fall, unseasonal as that might be.

On the other hand, gold's strength might evaporate on Monday and we'd be left with a summer correction to fill out, and lower prices. Right now, my instincts tell me the gold price is about to move higher, and drag the silver price with it.

STOCKS dropped today 34.01 to end at 8,438.39 (S&P500 fell 1.36 to 918.90). With all the nutty projects and changes coming out of Washington, how do they expect stocks ever to rise? Stocks hate uncertainty. Meanwhile, the government is changing all the rules, day by day. Worse, all these changes place permanent drags on the economy, new costs and charges that will continue to pull it underwater long after the current crop of goofs has left DC. If I had planned to de-industrialize the US and gut its economy, I couldn't have done a better job than the US government has done since 1945. Makes you wonder whose side they are on. Anyhow, stocks will fall again next week, and probably will hit 7,800 before this particular downtrend ends.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Thursday, June 25, 2009

If the Gold Price Closes Above 940 the Bottom for this Correction is Behind Us

Gold Price Close Today : 939.10

Change: 5.00 or 0.5%

Silver Price Close Today : 14.00

Change: 9.5 cents or 0.7%

Gold Silver Ratio: 66.84

Change: -0.094 or -0.1%

Dow Industrial: 8,472.40

Change: 172.54 or 2.1%

US Dollar Index: 80.l35

Change: -0.18

Heavens! The daily charts for silver and gold prices just look too strong for a continuing correction. After making a double bottom at 918 on Monday, the gold price tried Wednesday and Thursday to bull its way through 940 without success. If it closes above 940 then the bottom for this correction is behind us. If not, bottom probably still in, but the gold price must drop back down to last bottom to prove it.

The Silver Price daily chart looks just like gold's a flat-topped rising triangle. In a sane world that would mean it's about to break out to the upside, but we are not dealing with a sane world. For the silver price, 14.06 is the barrier. A close above that says silver's bottom is in, a close below that means silver must work a while longer on the downside.

Today the silver price on Comex closed up 9.5 cents at 14.005 cents while gold closed at US$939.10, up 5.00. I know it sounds crazy after this week's drop, but both silver and gold prices look poised to rise.

The US Dollar index dropped another 18.3 basis points today to stop at 80.354. It can't even push through 81. If the dollar index closes below 79.60, it will fall at least 200 basis points.

STOCKS have probably finished their downward move for a few days. Tuesday and Wednesday appear to have put in a little double bottom at about 8,260. After the big fall stocks are due for a little countertrend bounce.

I'm so far out of the mainstream I ought to be called the slipstream or the limpid pool or maybe rain puddle. I listen to economists on NPR (I know -- why would anybody do that? The crime is its own punishment) and they must be living in a parallel universe. At least, what they all see is invisible to me. I'll tell y'all what. If the elusive "bottom of this recession" actually happens this summer as they are predicting, then I'll make a promise: I have a large-brimmed straw hat I wear to mow. Next summer this time if the economy is just a-hummin' along, I'll go out in the yard in front of y'all and everybody and I will eat that straw hat. Shoot, I'll throw in a couple of big bugs, too.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: 5.00 or 0.5%

Silver Price Close Today : 14.00

Change: 9.5 cents or 0.7%

Gold Silver Ratio: 66.84

Change: -0.094 or -0.1%

Dow Industrial: 8,472.40

Change: 172.54 or 2.1%

US Dollar Index: 80.l35

Change: -0.18

Heavens! The daily charts for silver and gold prices just look too strong for a continuing correction. After making a double bottom at 918 on Monday, the gold price tried Wednesday and Thursday to bull its way through 940 without success. If it closes above 940 then the bottom for this correction is behind us. If not, bottom probably still in, but the gold price must drop back down to last bottom to prove it.

The Silver Price daily chart looks just like gold's a flat-topped rising triangle. In a sane world that would mean it's about to break out to the upside, but we are not dealing with a sane world. For the silver price, 14.06 is the barrier. A close above that says silver's bottom is in, a close below that means silver must work a while longer on the downside.

Today the silver price on Comex closed up 9.5 cents at 14.005 cents while gold closed at US$939.10, up 5.00. I know it sounds crazy after this week's drop, but both silver and gold prices look poised to rise.

The US Dollar index dropped another 18.3 basis points today to stop at 80.354. It can't even push through 81. If the dollar index closes below 79.60, it will fall at least 200 basis points.

STOCKS have probably finished their downward move for a few days. Tuesday and Wednesday appear to have put in a little double bottom at about 8,260. After the big fall stocks are due for a little countertrend bounce.

I'm so far out of the mainstream I ought to be called the slipstream or the limpid pool or maybe rain puddle. I listen to economists on NPR (I know -- why would anybody do that? The crime is its own punishment) and they must be living in a parallel universe. At least, what they all see is invisible to me. I'll tell y'all what. If the elusive "bottom of this recession" actually happens this summer as they are predicting, then I'll make a promise: I have a large-brimmed straw hat I wear to mow. Next summer this time if the economy is just a-hummin' along, I'll go out in the yard in front of y'all and everybody and I will eat that straw hat. Shoot, I'll throw in a couple of big bugs, too.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Tuesday, June 23, 2009

Gold Price Headed for US$1,300 and Higher, Most Likely by Year End

Gold Price Close Today : 923.90

Change: 3.30 or 0.4%

Silver Price Close Today : 13.834

Change: 14 cents or 1.0%

Gold Silver Ratio: 66.78

Change: -0.442 or -0.7%

Dow Industrial: 8,322.91

Change: -16.10 or -0.2%

US Dollar Index: 79.83

Change: -0.95 or -1.2%

The Silver Price closed today at 13.834, down 14, and is trapped under its 50 day moving average (now 13.81). That might mean that silver will fall to its 200 DMA (now 12.12). Markets tend often to do that, but it's not inevitable. More likely seems to me a drop to 13.00, maybe 13.50.

Why? Because the dollar lost momentum badly today, and I'm not sure it can continue to rally. Besides, time is running out for silver's seasonal low. However, other silver price indicators are not yet oversold, and I recognize that I am so bullish that I will always put the best colour on silver's outlook, as hard as I try to be objective.

Same outlook holds for gold price. It rose today 3.30 to US$923.90, but remains below its 50 DMA at 925.26. Will it drop to its 200 DMA at 870.74? Again, markets do not drop from the 50 DMA to 200 DMA every time. Over the last six months, the gold price has tended to drop back less than I expected, certainly less than the max I expected.

Torture is, you want to buy on a dip, but you can't know whether the dip is dipped out yet -- or not. Worst place to land is twisting in the breeze of indecision, blown first one way then the next, and you end up not buying anything. Keep on reminding yourself that after this correction ends, the gold price will be headed for US$1,300 and higher, most likely by year end.

When something is crazy, it invites comment. The US Dollar is crazy, so I will comment. Today the US Dollar index dropped nearly 100 basis points, 95.2 to be exact, to 79.831. Yes, it has fallen below 80 once again. This rallying project is not going to be as easy as the Nice Government Men thought. Somebody fought back today. Twice now the dollar's rally has been flung back at 81 - 81.50. What was an uptrend has now become a downtrend of lower highs and lower lows the last 7 days. Another new low tomorrow wrecks the downtrend channel and sends the dollar breaking out to the downside, contrary to my expectation.

Wow. Explain to me why the Dow won't drop to 7,800, because I can't see a reason. Indices were mixed today, some up, some down, not much movement. 'Tis a market undecided, but that generally means weakness.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: 3.30 or 0.4%

Silver Price Close Today : 13.834

Change: 14 cents or 1.0%

Gold Silver Ratio: 66.78

Change: -0.442 or -0.7%

Dow Industrial: 8,322.91

Change: -16.10 or -0.2%

US Dollar Index: 79.83

Change: -0.95 or -1.2%

The Silver Price closed today at 13.834, down 14, and is trapped under its 50 day moving average (now 13.81). That might mean that silver will fall to its 200 DMA (now 12.12). Markets tend often to do that, but it's not inevitable. More likely seems to me a drop to 13.00, maybe 13.50.

Why? Because the dollar lost momentum badly today, and I'm not sure it can continue to rally. Besides, time is running out for silver's seasonal low. However, other silver price indicators are not yet oversold, and I recognize that I am so bullish that I will always put the best colour on silver's outlook, as hard as I try to be objective.

Same outlook holds for gold price. It rose today 3.30 to US$923.90, but remains below its 50 DMA at 925.26. Will it drop to its 200 DMA at 870.74? Again, markets do not drop from the 50 DMA to 200 DMA every time. Over the last six months, the gold price has tended to drop back less than I expected, certainly less than the max I expected.

Torture is, you want to buy on a dip, but you can't know whether the dip is dipped out yet -- or not. Worst place to land is twisting in the breeze of indecision, blown first one way then the next, and you end up not buying anything. Keep on reminding yourself that after this correction ends, the gold price will be headed for US$1,300 and higher, most likely by year end.

When something is crazy, it invites comment. The US Dollar is crazy, so I will comment. Today the US Dollar index dropped nearly 100 basis points, 95.2 to be exact, to 79.831. Yes, it has fallen below 80 once again. This rallying project is not going to be as easy as the Nice Government Men thought. Somebody fought back today. Twice now the dollar's rally has been flung back at 81 - 81.50. What was an uptrend has now become a downtrend of lower highs and lower lows the last 7 days. Another new low tomorrow wrecks the downtrend channel and sends the dollar breaking out to the downside, contrary to my expectation.

Wow. Explain to me why the Dow won't drop to 7,800, because I can't see a reason. Indices were mixed today, some up, some down, not much movement. 'Tis a market undecided, but that generally means weakness.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Monday, June 22, 2009

Gold Price Momentum is to the Downside, but How Far?

Gold Price Close Today : 920.60

Change: -15.00 or -1.6%

Silver Price Close Today : 13.694

Change: -39.5 cents or -2.8%

Gold Silver Ratio: 67.23

Change: 0.820 or 1.2%

Dow Industrial: 8,339.01

Change: -200.72 or -2.4%

US Dollar Index: 80.27

Change: -0.30 or -0.4%

Big news today were the drops in silver and gold prices. Well, big news if you are a goof who listens to CNN and the others, and therefore didn't already know that silver and gold prices were correcting.

Looking closer, the metals move was widely blamed on the rallying dollar, but as y'all know, because y'all have been watching it with me, a 46 basis point move for the dollar, even a 46 bp move up, is nothing big for the dollar lately, so other forces must have been active, fullness of time or Nice government Men, I don't know which.

Today at the Comex close the Gold Price dropped 15 to close at 920.60, while the silver price dropped 39.5 cents to close at 13.6940. In the later market the gold price has risen to 922.20 and the silver price to 13.77.

The gold price dropped US$10 about 5:30 a.m. Eastern time. It fell to 918 support, then was stopped rising at 922. Clearly gold's momentum is to the downside, but how far? It will probably end about the same time the US Dollar tops, so another 1 - 4 weeks. The gold price barely broke its 50 DMA (924.38) and bias in a bull market is to remain above the 50 and 200 DMA. SO if the gold price holds on here, it won't revisit its 200 DMA (now 870.14). A more likely target is 906, but there is also support at 890, and rock solid support at 865. I don't expect to see 900 breached.

The Silver Price broke $14.00 about 5:00 a.m. EDT, hung at 13.80, then about 14:00 broke to $13.70. 13.50 promises to be the solid support. The silver price now stands at its 50 DMA (13.88) while the 200 DMA lies far below at 12.12.

GOLD/SILVER RATIO reached 67.23 today. If it trades above 68:1, swap gold for silver.

I have been recommending that y'all buy silver and gold on any decline -- well, here's a big one. We have to be somewhere near a bottom. Remember that silver and gold are in a primary bull market, and they will be rising again after this correction.

The manic-depressive US DOLLAR INDEX had another manic fit this morning and rose 46 basis points to end the day at 80.846. Looks to me there remains another 2 - 3 weeks on the dollar's manic spurt, then it drops again. First resistance stands at 81.50, then 82, then 82.60. Don't y'all get tired of this? Hogwash pouring in a tidal wave across media and markets, tugged first 180 degrees one way, then the next day 180 degrees the other. It betrays the massive fear, terror and uncertainty in markets.

STOCKS already stood beneath their 200 day moving average (DMA, now 8,553), & now they've fallen below their 50 DMA as well (8,378). If stocks break Dow 8,200 they will no doubt fall to the next support level, 7,800.

I intend to remain grouchy all week. All the women in our family, including my wife, have fled to a cabin on Pickwick Lake with all the children. For a week. I am always grouchy when my wife is away, but I won't get anything to eat all week, either. Nothing to look forward to until she returns.3

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: -15.00 or -1.6%

Silver Price Close Today : 13.694

Change: -39.5 cents or -2.8%

Gold Silver Ratio: 67.23

Change: 0.820 or 1.2%

Dow Industrial: 8,339.01

Change: -200.72 or -2.4%

US Dollar Index: 80.27

Change: -0.30 or -0.4%

Big news today were the drops in silver and gold prices. Well, big news if you are a goof who listens to CNN and the others, and therefore didn't already know that silver and gold prices were correcting.

Looking closer, the metals move was widely blamed on the rallying dollar, but as y'all know, because y'all have been watching it with me, a 46 basis point move for the dollar, even a 46 bp move up, is nothing big for the dollar lately, so other forces must have been active, fullness of time or Nice government Men, I don't know which.

Today at the Comex close the Gold Price dropped 15 to close at 920.60, while the silver price dropped 39.5 cents to close at 13.6940. In the later market the gold price has risen to 922.20 and the silver price to 13.77.

The gold price dropped US$10 about 5:30 a.m. Eastern time. It fell to 918 support, then was stopped rising at 922. Clearly gold's momentum is to the downside, but how far? It will probably end about the same time the US Dollar tops, so another 1 - 4 weeks. The gold price barely broke its 50 DMA (924.38) and bias in a bull market is to remain above the 50 and 200 DMA. SO if the gold price holds on here, it won't revisit its 200 DMA (now 870.14). A more likely target is 906, but there is also support at 890, and rock solid support at 865. I don't expect to see 900 breached.

The Silver Price broke $14.00 about 5:00 a.m. EDT, hung at 13.80, then about 14:00 broke to $13.70. 13.50 promises to be the solid support. The silver price now stands at its 50 DMA (13.88) while the 200 DMA lies far below at 12.12.

GOLD/SILVER RATIO reached 67.23 today. If it trades above 68:1, swap gold for silver.

I have been recommending that y'all buy silver and gold on any decline -- well, here's a big one. We have to be somewhere near a bottom. Remember that silver and gold are in a primary bull market, and they will be rising again after this correction.

The manic-depressive US DOLLAR INDEX had another manic fit this morning and rose 46 basis points to end the day at 80.846. Looks to me there remains another 2 - 3 weeks on the dollar's manic spurt, then it drops again. First resistance stands at 81.50, then 82, then 82.60. Don't y'all get tired of this? Hogwash pouring in a tidal wave across media and markets, tugged first 180 degrees one way, then the next day 180 degrees the other. It betrays the massive fear, terror and uncertainty in markets.

STOCKS already stood beneath their 200 day moving average (DMA, now 8,553), & now they've fallen below their 50 DMA as well (8,378). If stocks break Dow 8,200 they will no doubt fall to the next support level, 7,800.

I intend to remain grouchy all week. All the women in our family, including my wife, have fled to a cabin on Pickwick Lake with all the children. For a week. I am always grouchy when my wife is away, but I won't get anything to eat all week, either. Nothing to look forward to until she returns.3

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Friday, June 19, 2009

Correction in Silver and Gold Prices is Not Over Yet

Gold Price Close Today : 935.60

Gold Price Close June 12: 940.10

Change: -4.50 or -0.5%

Silver Price Close Today : 14.189

Silver Price Close June 12: 14.865

Change: -67.60 cents or -4.5%

Gold Silver Ratio: 65.64

Gold Silver Ratio June 12: 65.64

Change: 2.70 or 2.70

Dow Industrial: 8,536.03

Dow June 12: 8,799.26

Change: -263.230 or -3.0%

US Dollar Index: 80.268

US Dollar June 12: 80.197

Change: 0.071 or 0.1%

For a rallying market, the US DOLLAR INDEX didn't make much headway this week. Today it gave up a whole week's progress. Scoreboard stands up 7 basis points, about 0.1%. Dollar's rally has yet a ways to run. Fed appears to be draining liquidity, which helps the dollar, but with congress voting yesterday to spend another $106 billion on perpetual-war-for-perpetual-prosperity, that won't help the dollar long term. However, for several more weeks the dollar will be causing trouble for metals.

STOCKS could not thread their way through 8700, and so fell back this week. Probably they haven't seen the end of the valley yet on this move. Longer term, keep your eyes open for Dow 6,000.

The DOW IN GOLD DOLLARS fell this week, knocked flat again off of G$193 (9.336 oz). Stocks will keep on under-performing gold for another long time it seems.

I've been studying gold and silver seasonality this week. Did y'all know that in 5 out of the last 8 bull market years, gold has posted its yearly low by 15 May? About half the time gold's high falls in December. Silver makes its low (on average) on 13 June. Of course, all those are averages and offer therefore only general guidance. In other words, you might get creamed following that for a trading guide, but you might not.

SILVER and GOLD PRICES have held up well this week. Primarily I was concerned whether the gold price could hold the 928 - 930 resistance area, and it did. Traded all the way up to 940, but couldn't break through yet.

Today on Comex the silver price closed down 4 cents at 14.189. The gold price closed up 1.60 at US$935.6

The silver price has been weaker during this correction, but that's like saying "water is wet." The silver price is more volatile, so of course is weaker in a correction. Still, the silver price has defended 14.00, and that's heartening.

Correction in silver and gold prices is not over yet. Seasonality suggests it has only a couple more weeks to run. A gold close below $900 would probably fall quickly to 865, but that's an outside chance. Silver might trade to 13.00 or 13.50. That's why these 930 and 14.00 levels successfully defended this week are so important. If we can go another week with those intact, then the correction's worst beating is behind us.

Gold and silver price long term trends are UP. Use every instance of price weakness to buy more.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Gold Price Close June 12: 940.10

Change: -4.50 or -0.5%

Silver Price Close Today : 14.189

Silver Price Close June 12: 14.865

Change: -67.60 cents or -4.5%

Gold Silver Ratio: 65.64

Gold Silver Ratio June 12: 65.64

Change: 2.70 or 2.70

Dow Industrial: 8,536.03

Dow June 12: 8,799.26

Change: -263.230 or -3.0%

US Dollar Index: 80.268

US Dollar June 12: 80.197

Change: 0.071 or 0.1%

For a rallying market, the US DOLLAR INDEX didn't make much headway this week. Today it gave up a whole week's progress. Scoreboard stands up 7 basis points, about 0.1%. Dollar's rally has yet a ways to run. Fed appears to be draining liquidity, which helps the dollar, but with congress voting yesterday to spend another $106 billion on perpetual-war-for-perpetual-prosperity, that won't help the dollar long term. However, for several more weeks the dollar will be causing trouble for metals.

STOCKS could not thread their way through 8700, and so fell back this week. Probably they haven't seen the end of the valley yet on this move. Longer term, keep your eyes open for Dow 6,000.

The DOW IN GOLD DOLLARS fell this week, knocked flat again off of G$193 (9.336 oz). Stocks will keep on under-performing gold for another long time it seems.

I've been studying gold and silver seasonality this week. Did y'all know that in 5 out of the last 8 bull market years, gold has posted its yearly low by 15 May? About half the time gold's high falls in December. Silver makes its low (on average) on 13 June. Of course, all those are averages and offer therefore only general guidance. In other words, you might get creamed following that for a trading guide, but you might not.

SILVER and GOLD PRICES have held up well this week. Primarily I was concerned whether the gold price could hold the 928 - 930 resistance area, and it did. Traded all the way up to 940, but couldn't break through yet.

Today on Comex the silver price closed down 4 cents at 14.189. The gold price closed up 1.60 at US$935.6

The silver price has been weaker during this correction, but that's like saying "water is wet." The silver price is more volatile, so of course is weaker in a correction. Still, the silver price has defended 14.00, and that's heartening.

Correction in silver and gold prices is not over yet. Seasonality suggests it has only a couple more weeks to run. A gold close below $900 would probably fall quickly to 865, but that's an outside chance. Silver might trade to 13.00 or 13.50. That's why these 930 and 14.00 levels successfully defended this week are so important. If we can go another week with those intact, then the correction's worst beating is behind us.

Gold and silver price long term trends are UP. Use every instance of price weakness to buy more.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Thursday, June 18, 2009

The Gold Price Couldn't Break Through $940 on the First Try

Gold Price Close Today : 934.00

Change: -1.40 or -0.1%

Silver Price Close Today : 14.229

Change: -4 cents or -0.3%

Gold Silver Ratio: 65.64

Change: 0.086 or 0.1%

Dow Industrial: 8,555.60

Change: 58.42 or 0.7%

US Dollar Index: 80.60

Change: 0.40 or 0.5%

The GOLD PRICE closed on Comex down $1.40 at US$934. It held on most of the day above $936, but something around 12:30 EDT took the gold price down another couple of bucks. Low was $929.75, and by now gold has eroded to $931.10. Remember yesterday I suspected that the gold price would not break through $940 on the first try, and it didn't. Now it will test the downside of the range.

The SILVER PRICE could not climb above $14.40 and just trailed off all day. However, it remained above $14.06. Low was $14.12.

On Comex the silver price closed at $14.22, down 4 cents, and now is trading at $14.18. Tomorrow we will see exactly how strong silver is and how long this correction will last.

US DOLLAR INDEX today rose 39.8 basis points to 80.597. Yes, it is headed higher, but against a mighty head win of contempt, distrust, and suspicion. 82.5 or 83 probably will mark its high.

STOCKS held on where they were today. Dow gained 58 to close at 8,555.60 and S&P 500 rose 7.66 to 918.37. Looks like time has come for a down leg in stocks that could touch 8,000 Dow.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: -1.40 or -0.1%

Silver Price Close Today : 14.229

Change: -4 cents or -0.3%

Gold Silver Ratio: 65.64

Change: 0.086 or 0.1%

Dow Industrial: 8,555.60

Change: 58.42 or 0.7%

US Dollar Index: 80.60

Change: 0.40 or 0.5%

The GOLD PRICE closed on Comex down $1.40 at US$934. It held on most of the day above $936, but something around 12:30 EDT took the gold price down another couple of bucks. Low was $929.75, and by now gold has eroded to $931.10. Remember yesterday I suspected that the gold price would not break through $940 on the first try, and it didn't. Now it will test the downside of the range.

The SILVER PRICE could not climb above $14.40 and just trailed off all day. However, it remained above $14.06. Low was $14.12.

On Comex the silver price closed at $14.22, down 4 cents, and now is trading at $14.18. Tomorrow we will see exactly how strong silver is and how long this correction will last.

US DOLLAR INDEX today rose 39.8 basis points to 80.597. Yes, it is headed higher, but against a mighty head win of contempt, distrust, and suspicion. 82.5 or 83 probably will mark its high.

STOCKS held on where they were today. Dow gained 58 to close at 8,555.60 and S&P 500 rose 7.66 to 918.37. Looks like time has come for a down leg in stocks that could touch 8,000 Dow.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Wednesday, June 17, 2009

If the Gold Price Low Was Not on Monday it is Close to a Bottom

Gold Price Close Today : 935.40

Change: 3.80 or 0.4%

Silver Price Close Today : 14.269

Change: 14.9 cents or 1.1%

Gold Silver Ratio: 65.55

Change: -0.423 or -0.6%

Dow Industrial: 8,497.18

Change: -7.49 or -0.1%

US Dollar Index: 80.26

Change: -0.48 or -0.6%

Somebody raided gold on the opening, driving it down to to $928.14 suddenly. Whoops! It was utterly without effect. The GOLD PRICE climbed steadily all day to close up $3.80 by the Comex close (12:30 CDT at US$935.40). At 1700, my time, gold is trading at $939.20. In other words, gold gained steadily throughout the day. Now it has reached resistance at $940. Tomorrow it will surely test that, but probably won't pierce it on the first try. If not, the bounce off $940 will tell us how hard and long the rest of this correction will be. As long as the gold price doesn't close below $926.80, the correction will be short and shallow. If it closes below $920, 'twill take a little longer.

In the last three days' trading the SILVER PRICE appears to have made a rounding double bottom at $14.06. As I observed yesterday, silver will at least trade up to $14.60 to fill that $14.40 - $14.60 gap its fall left on the chart.

At Comex close silver settled at $14.29, up 14.90 cents. At the end of my day, it's trading up another 12.1 cents at $14.39. So with silver we are watching $14.60 and $14.06. Long as it remains above 14.06, we'll keep assuming silver has bottomed.

Y'all don't forget what I said about this time of year. The seasonality charts for both silver and gold prices expect lows around this time of the year. So whether we saw lows on Monday, or whether they fall a little more, in time at least we are close to bottoms.

STOCKS today fell only slightly and traded in a fairly narrow range, closing down 7.49 on the Dow at 8,497.18. S&P dropped 1.26 to 910.71. If stocks do not hold on here, their next stop is 8,200.

US DOLLAR INDEX dropped a huge 48.2 basis points to 80.262. As usual, the dollar is wearing out friends, but its enemies never tire.

I want to get one thing straight in y'all's heads. The single most important principle in investing is always invest with, and never against, the primary trend. By primary trend I mean the 15 to 20 year general up ("bull market") or down ("bear market") trend. Never buck the primary trend -- never. That rule means you must not buy stocks or dollar denominated investments, because stocks and dollars are locked in bear trends that will continue at least until 2015.

If y'all never remember another word I write, never forget this: the trend is your friend. You will NEVER beat the trend.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: 3.80 or 0.4%

Silver Price Close Today : 14.269

Change: 14.9 cents or 1.1%

Gold Silver Ratio: 65.55

Change: -0.423 or -0.6%

Dow Industrial: 8,497.18

Change: -7.49 or -0.1%

US Dollar Index: 80.26

Change: -0.48 or -0.6%

Somebody raided gold on the opening, driving it down to to $928.14 suddenly. Whoops! It was utterly without effect. The GOLD PRICE climbed steadily all day to close up $3.80 by the Comex close (12:30 CDT at US$935.40). At 1700, my time, gold is trading at $939.20. In other words, gold gained steadily throughout the day. Now it has reached resistance at $940. Tomorrow it will surely test that, but probably won't pierce it on the first try. If not, the bounce off $940 will tell us how hard and long the rest of this correction will be. As long as the gold price doesn't close below $926.80, the correction will be short and shallow. If it closes below $920, 'twill take a little longer.

In the last three days' trading the SILVER PRICE appears to have made a rounding double bottom at $14.06. As I observed yesterday, silver will at least trade up to $14.60 to fill that $14.40 - $14.60 gap its fall left on the chart.

At Comex close silver settled at $14.29, up 14.90 cents. At the end of my day, it's trading up another 12.1 cents at $14.39. So with silver we are watching $14.60 and $14.06. Long as it remains above 14.06, we'll keep assuming silver has bottomed.

Y'all don't forget what I said about this time of year. The seasonality charts for both silver and gold prices expect lows around this time of the year. So whether we saw lows on Monday, or whether they fall a little more, in time at least we are close to bottoms.

STOCKS today fell only slightly and traded in a fairly narrow range, closing down 7.49 on the Dow at 8,497.18. S&P dropped 1.26 to 910.71. If stocks do not hold on here, their next stop is 8,200.

US DOLLAR INDEX dropped a huge 48.2 basis points to 80.262. As usual, the dollar is wearing out friends, but its enemies never tire.

I want to get one thing straight in y'all's heads. The single most important principle in investing is always invest with, and never against, the primary trend. By primary trend I mean the 15 to 20 year general up ("bull market") or down ("bear market") trend. Never buck the primary trend -- never. That rule means you must not buy stocks or dollar denominated investments, because stocks and dollars are locked in bear trends that will continue at least until 2015.

If y'all never remember another word I write, never forget this: the trend is your friend. You will NEVER beat the trend.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Tuesday, June 16, 2009

Daily Gold Price Chart Looks Like Monday Marked a Bottom for a While

Gold Price Close Today : 931.60

Change: 4.70 or 0.5%

Silver Price Close Today : 14.120

Change: 10 cents or 0.7%

Gold Silver Ratio: 65.98

Change: -0.135 or -0.2%

Dow Industrial: 8,504.67

Change: -107.46 or -1.2%

US Dollar Index: 80.72

Change: -0.44 or -0.5%

STOCKS look awfully sick. Dow rose to hit its 200 day moving average (DMA, today 8,612), and rolled over like a roach hit with Raid, feet in the air. A correction here in the unsupported summertime could get bloody. I truly hope y'all do not own stocks.

US DOLLAR INDEX, with its up/down, up/down, has turned its V-bottom into a mushy W written by someone holding the pencil in his mouth. Will probably keep on climbing, but strong one day, weak the next.

GOLD's 50 Day Moving Average (DMA) at 920 really looks like a spot where gold could turn around. Ditto Silver at its 13.73 -50 DMA. Gold's low today was 929.90. Hmmmm. Daily gold price chart looks like Monday marked a bottom for a while.

SILVER's daily chart has a big gap between 14.40 and 14.60. Because markets nearly always fill gaps, a move to 14.60 will not mean anything -- yet. Although silver's chart is not nearly as plain or strong as gold's, still today probably marked at least a temporary bottom. However, it must hold 14.07.

GOLD/SILVER RATIO today near 66 must be hovering somewhere near a top. Right, it might rise to 67.50 where it fell off earlier, but 66 will work, too.

Yes, the silver price took a hard blow yesterday, as did the gold price , but it's not a catastrophe. Use these low silver and gold price opportunities to buy more.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: 4.70 or 0.5%

Silver Price Close Today : 14.120

Change: 10 cents or 0.7%

Gold Silver Ratio: 65.98

Change: -0.135 or -0.2%

Dow Industrial: 8,504.67

Change: -107.46 or -1.2%

US Dollar Index: 80.72

Change: -0.44 or -0.5%

STOCKS look awfully sick. Dow rose to hit its 200 day moving average (DMA, today 8,612), and rolled over like a roach hit with Raid, feet in the air. A correction here in the unsupported summertime could get bloody. I truly hope y'all do not own stocks.

US DOLLAR INDEX, with its up/down, up/down, has turned its V-bottom into a mushy W written by someone holding the pencil in his mouth. Will probably keep on climbing, but strong one day, weak the next.

GOLD's 50 Day Moving Average (DMA) at 920 really looks like a spot where gold could turn around. Ditto Silver at its 13.73 -50 DMA. Gold's low today was 929.90. Hmmmm. Daily gold price chart looks like Monday marked a bottom for a while.

SILVER's daily chart has a big gap between 14.40 and 14.60. Because markets nearly always fill gaps, a move to 14.60 will not mean anything -- yet. Although silver's chart is not nearly as plain or strong as gold's, still today probably marked at least a temporary bottom. However, it must hold 14.07.

GOLD/SILVER RATIO today near 66 must be hovering somewhere near a top. Right, it might rise to 67.50 where it fell off earlier, but 66 will work, too.

Yes, the silver price took a hard blow yesterday, as did the gold price , but it's not a catastrophe. Use these low silver and gold price opportunities to buy more.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Monday, June 15, 2009

Average Seasonal Gold Price Low Takes Place on June 13

Gold Price Close Today : 926.90

Change: -13.20 or -1.4%

Silver Price Close Today : 14.020

Change: -84.5 cents or -5.7%

Gold Silver Ratio: 66.11

Change: 2.870 or 4.5%

Dow Industrial: 8,612.13

Change: -187.13 or -2.1%

US Dollar Index: 81.09

Change: 0.87 or 1.1%

Tornado spawning storms are headed my way, so I'll have to make this fast.

US Dollar index rose sharply today, up 87 basis points to 81.085. That wouldn't make much difference to silver and gold were they rallying, but they're correcting, so it hurts. Top on US dollar index is 82, but perhaps as high as 200 day moving average at 83.58.

Rising dollar recently (for reasons mysterious) hurts stocks as much as metals. (Maybe not so mysterious, though -- at least stocks represent something, whereas a US Dollar is simply an I-O-U-nothing.) Dow dropped 187.13 today (2.1%) to 8,612.13. S&P 500 fell even harder, down 22.49 to 923.72. Nice Government Men better hope that US Dollar doesn't rally too long, or the "Myth of Recovery" whirling around a "rising" stock market will vanish with the mist.

The GOLD PRICE took a hard lick today, down 13.20 to close on Comex at 926.90. Trading in the current market at 928. This is the support area that should have stopped it -- so far so good. The SILVER PRICE showed its superior volatility on the downside today with an 84.5 cent fall to 14.02 cents.

When endeth the pain? Not long. Often these waterfalls are over in 10 - 11 days, or have at least hit their lows. Still, let's look at the downside possibilities.

WAIT! Wait! Did I forget to tell y'all something I discovered today? Working on seasonality of metals, I found that for the last 10 years, the average (not actual) seasonal low for silver and gold prices takes place on June 13. Since that's an average, it might move several weeks either way in any given year, but the point is clear: we are near a bottom in time (seasonality).

Percentage wise silver will, as usual, fall further than gold. Silver could stop here at 14.00, or drop to 13.80-13.50, or 13.00. My guess is for less correction rather than more, so I am watching 14.00 and 13.80 closely. The gold price might stop here around 928-930, where we spent a week when we were rising, but might also stop at 920, 900, or 890. Right now, US$900 is the lowest I see, but the market speaks every day and I can but listen.

Don't let this drop in silver and gold prices bother you. Remember, both are in a long term primary uptrend (bull market) and the trend is your friend. Best bull market strategy is to buy, hold, and buy more.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: -13.20 or -1.4%

Silver Price Close Today : 14.020

Change: -84.5 cents or -5.7%

Gold Silver Ratio: 66.11

Change: 2.870 or 4.5%

Dow Industrial: 8,612.13

Change: -187.13 or -2.1%

US Dollar Index: 81.09

Change: 0.87 or 1.1%

Tornado spawning storms are headed my way, so I'll have to make this fast.

US Dollar index rose sharply today, up 87 basis points to 81.085. That wouldn't make much difference to silver and gold were they rallying, but they're correcting, so it hurts. Top on US dollar index is 82, but perhaps as high as 200 day moving average at 83.58.

Rising dollar recently (for reasons mysterious) hurts stocks as much as metals. (Maybe not so mysterious, though -- at least stocks represent something, whereas a US Dollar is simply an I-O-U-nothing.) Dow dropped 187.13 today (2.1%) to 8,612.13. S&P 500 fell even harder, down 22.49 to 923.72. Nice Government Men better hope that US Dollar doesn't rally too long, or the "Myth of Recovery" whirling around a "rising" stock market will vanish with the mist.

The GOLD PRICE took a hard lick today, down 13.20 to close on Comex at 926.90. Trading in the current market at 928. This is the support area that should have stopped it -- so far so good. The SILVER PRICE showed its superior volatility on the downside today with an 84.5 cent fall to 14.02 cents.

When endeth the pain? Not long. Often these waterfalls are over in 10 - 11 days, or have at least hit their lows. Still, let's look at the downside possibilities.

WAIT! Wait! Did I forget to tell y'all something I discovered today? Working on seasonality of metals, I found that for the last 10 years, the average (not actual) seasonal low for silver and gold prices takes place on June 13. Since that's an average, it might move several weeks either way in any given year, but the point is clear: we are near a bottom in time (seasonality).

Percentage wise silver will, as usual, fall further than gold. Silver could stop here at 14.00, or drop to 13.80-13.50, or 13.00. My guess is for less correction rather than more, so I am watching 14.00 and 13.80 closely. The gold price might stop here around 928-930, where we spent a week when we were rising, but might also stop at 920, 900, or 890. Right now, US$900 is the lowest I see, but the market speaks every day and I can but listen.

Don't let this drop in silver and gold prices bother you. Remember, both are in a long term primary uptrend (bull market) and the trend is your friend. Best bull market strategy is to buy, hold, and buy more.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Friday, June 12, 2009

Monday or Tuesday Ought to Mark the Gold Price Low

Gold Price Close Today : 940.10

Gold Price Close June 5th : 961.70

Change: -51.10 or -3.3%

Silver Price Close Today : 14.865

Silver Price Close June 5th : 15.376

Change: -21.60 cents or -2.2%

Gold Silver Ratio: 63.24

Gold Silver Ratio June 5th : 62.55

Change: 0.70 or 1.1%

Dow Industrial: 8,799.26

Dow June 5th : 8,763.13

Change: 36.130 or 0.4%

US Dollar Index: 80.197

US Dollar June 5th: 80.677

Change: -0.480 or -0.6%

This week only proved that the US Dollar is rallying (temporarily) while silver and gold prices are correcting a bit and stocks are dithering at 8700. As a friend said to me today, this summer may be your last chance to buy gold under $1,000 and silver under $16.00.

Before we go further, look at the Dow In Gold Dollars (DiG$) It rose G$5.12 (0.225 oz) this week, to rest today at G$193.49(9.360 oz). That's intriguing, because the DiG$ has stopped above $193 four times since 17 April, and afterwards immediately fell back, as if it had been hit in the head with a hammer. The DiG$ of course, shows us how stocks are performing against gold. Those repeated rises to G$193+ might leave you remembering what I have said so often about markets: up or down, the more times a market tests a level, the greater the likelihood it will eventually break that level. So, Moneychanger, why isn't the DiG$ telling us now that stocks are about to soar against gold?

Because on the chart the DiG$ has painted out a Broadening Top, with highs at nearly the same place and a series of lower lows. Looks like a megaphone pointed right. It's generally a dead-on indicator that a market will plunge, although it takes a while to work out, slow but reliable.

Conclusion: stocks have reached a peak against gold, and gold will shortly begin outperforming stocks again soon.

I've been expecting that this precious metals correction would be a short, shallow affair. If the February silver peak (about 14.50) doesn't hold, though, silver could drop to 13.00. That's not what I expect -- I expect $14.50 to hold -- but that's a small possibility. Long before that, however, comes in support at $14.00.

Today confirmed my suspicion that the metals rally last week was the 2nd leg up ("B" leg) before the 3rd and final leg down ("C"). Most likely that means silver will see a bottom below 14.74 and the gold price below 940. Of course, these are merely my fine guesses what will happen. Don't let the best become the enemy of the good. Silver and Gold are in a bull market: that rising market will easily bail out all your timing mistakes. So don't snooker yourself by not buying at 14.75 because you expect it to fall to 14.50.

For both gold and silver, Monday or Tuesday ought to mark the low.

GOLD PRICE today dropped $21.20 to close at US$940.10. Next support lies at 930. The Silver Price dropped 61.6cents to close on Comex at 14.8650 (low at 14.785). At 1700 Central time they are trading at 939.3 and 14.85 -- not too enthusiastic.

The US DOLLAR index was pressuring metals today. The[shabby] paper dollar rose 63.3 basis points to 80.197. Look for this rally to slam into 82 like Wile E. Coyote slamming into a brick wall, in 3 - 4 weeks at most.

STOCKS have dithered around 8700 all week, climbing at last today to 8,799.26. I have still been waiting for the Dow to reach 9,000 - 9,700, but it's running out of time. Stocks don't like a rising dollar, either, but if they don't begin rising again on Monday, will they ever? As I have long advised get out of stocks and stay out. Still holding stocks? Sell from 9,000 to 9,700.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Gold Price Close June 5th : 961.70

Change: -51.10 or -3.3%

Silver Price Close Today : 14.865

Silver Price Close June 5th : 15.376

Change: -21.60 cents or -2.2%

Gold Silver Ratio: 63.24

Gold Silver Ratio June 5th : 62.55

Change: 0.70 or 1.1%

Dow Industrial: 8,799.26

Dow June 5th : 8,763.13

Change: 36.130 or 0.4%

US Dollar Index: 80.197

US Dollar June 5th: 80.677

Change: -0.480 or -0.6%

This week only proved that the US Dollar is rallying (temporarily) while silver and gold prices are correcting a bit and stocks are dithering at 8700. As a friend said to me today, this summer may be your last chance to buy gold under $1,000 and silver under $16.00.

Before we go further, look at the Dow In Gold Dollars (DiG$) It rose G$5.12 (0.225 oz) this week, to rest today at G$193.49(9.360 oz). That's intriguing, because the DiG$ has stopped above $193 four times since 17 April, and afterwards immediately fell back, as if it had been hit in the head with a hammer. The DiG$ of course, shows us how stocks are performing against gold. Those repeated rises to G$193+ might leave you remembering what I have said so often about markets: up or down, the more times a market tests a level, the greater the likelihood it will eventually break that level. So, Moneychanger, why isn't the DiG$ telling us now that stocks are about to soar against gold?

Because on the chart the DiG$ has painted out a Broadening Top, with highs at nearly the same place and a series of lower lows. Looks like a megaphone pointed right. It's generally a dead-on indicator that a market will plunge, although it takes a while to work out, slow but reliable.

Conclusion: stocks have reached a peak against gold, and gold will shortly begin outperforming stocks again soon.

I've been expecting that this precious metals correction would be a short, shallow affair. If the February silver peak (about 14.50) doesn't hold, though, silver could drop to 13.00. That's not what I expect -- I expect $14.50 to hold -- but that's a small possibility. Long before that, however, comes in support at $14.00.

Today confirmed my suspicion that the metals rally last week was the 2nd leg up ("B" leg) before the 3rd and final leg down ("C"). Most likely that means silver will see a bottom below 14.74 and the gold price below 940. Of course, these are merely my fine guesses what will happen. Don't let the best become the enemy of the good. Silver and Gold are in a bull market: that rising market will easily bail out all your timing mistakes. So don't snooker yourself by not buying at 14.75 because you expect it to fall to 14.50.

For both gold and silver, Monday or Tuesday ought to mark the low.

GOLD PRICE today dropped $21.20 to close at US$940.10. Next support lies at 930. The Silver Price dropped 61.6cents to close on Comex at 14.8650 (low at 14.785). At 1700 Central time they are trading at 939.3 and 14.85 -- not too enthusiastic.

The US DOLLAR index was pressuring metals today. The[shabby] paper dollar rose 63.3 basis points to 80.197. Look for this rally to slam into 82 like Wile E. Coyote slamming into a brick wall, in 3 - 4 weeks at most.

STOCKS have dithered around 8700 all week, climbing at last today to 8,799.26. I have still been waiting for the Dow to reach 9,000 - 9,700, but it's running out of time. Stocks don't like a rising dollar, either, but if they don't begin rising again on Monday, will they ever? As I have long advised get out of stocks and stay out. Still holding stocks? Sell from 9,000 to 9,700.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Thursday, June 11, 2009

Is the Gold Price Correction Over Or is Another Leg Down Coming?

Gold Price Close Today : 961.30

Change: 7.30 or 0.8%

Silver Price Close Today : 15.480

Change: 26.8 or 1.8%

Gold Silver Ratio: 62.10

Change: -0.614 or -1.0%

Dow Industrial: 8,770.95

Change: 31.90 or 0.4%

US Dollar Index: 79.53

Change: -0.80 or -1.0%

Most corrections play themselves out as three waves: down (A), up (B), down [C]. Treacherous part of that is the B wave is often so strong it convinces you that the correction is over, when in fact there's another leg down coming. That could be where we are today with silver and gold prices.

Today silver and gold prices looked strong as a garlic milkshake. The Gold Price rose 7.30 to 961.30 and the Silver Price rose 26.8 cents to 15.481 Yet remember this area caused trouble for silver earlier, and the gold price finds resistance where it is as well.

And I could be wrong, too. However, correction won't be over until silver price closes over 16.00 and the gold price over 983.

US DOLLAR INDEX lived up to its recent record of volatility, dropping 80 basis points today to land at 79.532. Market doesn't believe it's worth 80, apparently. But the dollar is rallying, and has only just begun. It will see 82 before that ends.

STOCKS fiddled today, too. The Dow rose 31.9 to 8,770.95 and S&P500 rose 5.74 to 944.89.

Y'all need to bear in mind that during the summer, everybody goes away. That affects markets as well, so they tend to sort of float sideways. But stay alert, because whenever you see silver or gold prices dip, buy them. 'Twill be higher next fall.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

Change: 7.30 or 0.8%

Silver Price Close Today : 15.480

Change: 26.8 or 1.8%

Gold Silver Ratio: 62.10

Change: -0.614 or -1.0%

Dow Industrial: 8,770.95

Change: 31.90 or 0.4%

US Dollar Index: 79.53

Change: -0.80 or -1.0%

Most corrections play themselves out as three waves: down (A), up (B), down [C]. Treacherous part of that is the B wave is often so strong it convinces you that the correction is over, when in fact there's another leg down coming. That could be where we are today with silver and gold prices.

Today silver and gold prices looked strong as a garlic milkshake. The Gold Price rose 7.30 to 961.30 and the Silver Price rose 26.8 cents to 15.481 Yet remember this area caused trouble for silver earlier, and the gold price finds resistance where it is as well.

And I could be wrong, too. However, correction won't be over until silver price closes over 16.00 and the gold price over 983.

US DOLLAR INDEX lived up to its recent record of volatility, dropping 80 basis points today to land at 79.532. Market doesn't believe it's worth 80, apparently. But the dollar is rallying, and has only just begun. It will see 82 before that ends.

STOCKS fiddled today, too. The Dow rose 31.9 to 8,770.95 and S&P500 rose 5.74 to 944.89.

Y'all need to bear in mind that during the summer, everybody goes away. That affects markets as well, so they tend to sort of float sideways. But stay alert, because whenever you see silver or gold prices dip, buy them. 'Twill be higher next fall.