| 10-Nov-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,088.20 | 0.60 | 0.06% |

| Silver Price, $/oz | 14.36 | -0.06 | -0.40% |

| Gold/Silver Ratio | 75.801 | 0.347 | 0.46% |

| Silver/Gold Ratio | 0.0132 | -0.0001 | -0.46% |

| Platinum Price | 899.50 | -25.20 | -2.73% |

| Palladium Price | 597.60 | -16.00 | -2.61% |

| S&P 500 | 2,081.72 | 3.14 | 0.15% |

| Dow | 17,758.21 | 27.73 | 0.16% |

| Dow in GOLD $s | 337.34 | 0.34 | 0.10% |

| Dow in GOLD oz | 16.32 | 0.02 | 0.10% |

| Dow in SILVER oz | 1,236.99 | 6.90 | 0.56% |

| US Dollar Index | 99.26 | 1.21 | 1.23% |

|

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

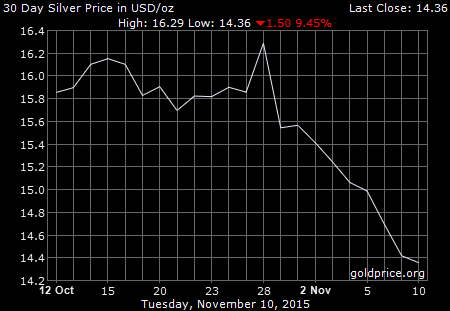

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

First wonder is that the GOLD/SILVER RATIO, today at 75.801, has not risen like a rocket on this long-lived silver and GOLD PRICE weakness. Normally I would expect that, but it appeareth not. Why not?

Except for those miraculous instantaneous drops, the price of gold is flatlining. Trading range today was only $10.00. Somebody stick a mirror under gold's nose to see if it's still breathing. Been dropping ten days now, and that alone argues it ought to rally just for a little relief. None appeareth. I can look at the chart and see intraday lows both Friday and today, but am I bold enough -- fool enough -- to that a double bottom? Not yet.

The SILVER PRICE low today hit $14.27. That marked a lower V-bottom than anything yet for this move, but no other hint of life.

Back in 2001, silver's bottom at $4.01 [sic] came in November. Seasonally, lows tend to take place in November for silver and gold prices, leading into rallies into year end. Take 2014 as a case in point. Knowing that, and that gold and silver's strongest, most determined, and most powerful allies are the Federal Reserve and the US government, spending and printing, printing and spending, I can wait. I know my government and my central bank won't let me down.

Today was one of those days the news forgot to show up, so nothing happened. Well, millions of Americans did the really important things -- got up to do their duty, kissed spouse and children, worked all day faithfully -- but nobody but me is much impressed by that.

Stocks spent most of the day underwater but finally about 2:30 found "sponsorship" to boost them above the unchanged line. Dow added an infinitesimal 27.73 to close 17,758.21, while the S&P500 gained 3.14 (0.15%) to 2,081.72. Get out the writin' paper and write home to Mama!

|

| Dow in Gold |

|

| Dow in Silver |

US dollar index scarfed up 31 basis points (0.32%) today for a 99.39 close. We'll find out tomorrow whether the dollar is of a mind to climb higher immediately. Fed apparatchiki are still firing that blarney cannon about raising interest rates. Sure, sure, and suck all the money out of all the rest of the world into the United States and precipitate a Depression even greater than the Great Depression. Come on, Feddists! I have faith in y'all. I know y'all really are stupid enough to do it, and without even gruntin'.

By the way, did y'all know that there is not one documented case in history of a banker drowning in his own sweat? If I'm lying, I'm dying.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.