Gold Price Close 2 July: 930.70

Change: -18.50 or -2.0%

Silver Price Close Today : 12.637

Silver Price Close 2 July: 13.394

Change: -75.70 cents or -5.7%

Gold Silver Ratio Today: 72.18

Gold Silver Ratio 2 July: 69.49

Change: 2.70 or 3.9%

Dow Industrial: 8,146.52

Dow 2 July: 8,280.74

Change: -134.220 or -1.6%

US Dollar Index: 80.244

US Dollar 2 July: 80.284

Change: -0.040 or 0.0%

It was a rough week for everything. The US DOLLAR INDEX closed today at 80.244, up 30.9 basis points from yesterday, but down 4 basis points for the week. The dollar remains range bound, between 79.50 and 81.00. There must be a huge number of people ready to short the dollar every time it nears 81. I can't seen any reason to expect strength out of the dollar any time soon, but a close above 81 would prove me wrong.

STOCKS are locked in a downtrend headed for 7,800 over the next four weeks. Dow today closed at 8,146.52, down 36.65, and S&P500 closed at 879.13, down 3.55 basis points.

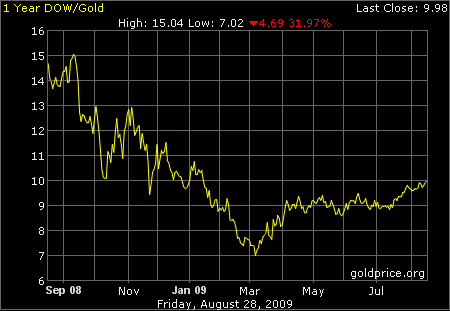

What makes me curious is the DOW IN GOLD DOLLARS. It keeps hanging around G$185 (8.95 oz). Dow falls, then the dollar seems to fall just enough to keep the Dow in Gold Dollars around G$185. Odd. I don't think stocks are about to scoot off and leave gold standing still, but it provokes thought to see the DiG$ failing to move lower as stocks move lower.

Likewise another puzzler is the GOLD/SILVER RATIO. It has now reached a relatively high level, just above 72. Time to trade gold for silver. I favour an allotment of 70% silver to 30% gold, based on this high ratio. Here's your chance to adjust your portfolio to a greater silver share.

The gold price closed today down 3.70 at US$912.20. The gold price does not appear ready to turn around, so expect a couple more weeks of sidewise to lower prices. Since gold is leading metals right now, silver will merely tag along. But even as these words drip off my fingertips. I hesitate, remember the instability in the world today. Tomorrow we wake up and anything could happen, literally anything. That's one reason you must go ahead and establish your silver and gold position now.

Looking at gold's week, it bottomed Wednesday (intraday)just below 906. So long as gold closeth not below 906, its correction has been completed. Today's low (907.24) shows that the gold price has yet a fight in front of it.

Upside the gold price needs to clear 930, then 942 quickly. If it breaks 906-900, it could fall as low as 865. More likely is a quick plunge to 890 support, or even to the 200 DMA at 877.

The silver price dropped sharply again today, down 28.7 cents to 12.6370. On its weekly chart the silver price has broken its 200 DMA (12.93). The RSI and MACD are not yet ready to turn around, but the same indicators on silver's daily chart appear likely to turn up.

Who knows, the silver price may have bottomed today when it made a little double bottom at 12.52. To prove the correction is past, silver must rise and close above 13.75. Otherwise it will trade sidewise to lower, maybe dropping to the 200 DMA (now 12.23) or even to 12.00.

It's a bull market. The trend will kindly cover a multitude of timing mistakes. Keep buying on dips. Don't let current weakness take your eyes off the strong long term

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.