Gold Price Close August 28: 957.00

Change: 38.80 or 4.1%

Silver Price Close Today : 16.268

Silver Price Close August 28: 14.784

Change: 148.40 cents or 10.0%

Platinum Price Close Today: 1,258.00

Platinum Price August 28: 1,245.30

Change: 12.700 or 1.0%

Palladium Price Close Today: 295.00

Palladium Price August 28 : 287.80

Change: 7.200 or 2.5%

Gold Silver Ratio Today: 61.21

Gold Silver Ratio August 28: 64.73

Change: 3.52 or -5.4%

Dow Industrial: 9,441.27

Dow Industrial August 28: 9,544.20

Change: -102.930 or -1.1%

US Dollar Index: 78.136

US Dollar Index August 28: 78.366

Change: -0.230 or -0.3%

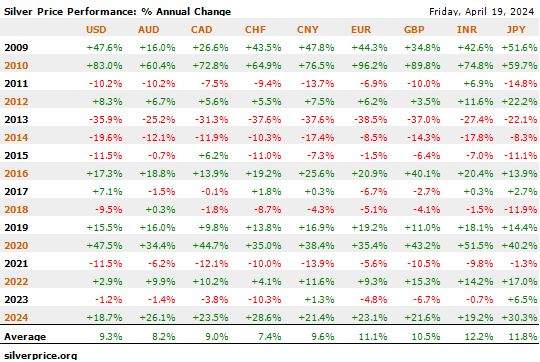

Although the US Dollar Index has not confirmed a fall by closing below 77.50, it lost 23 basis points this week and closed today beneath 78.33 support. The relatively small fall in the dollar does not justify the large rises in silver and gold prices, so something else is driving metals up. Notice that silver and gold prices are rising against ALL fiat currencies, not only the scrofulous US dollar.

Let me get stocks out of the way. Today stocks rose fairly strongly. The Dow rose 96.66 to close at 9,441.27, losing 102.93 points for the week. S&P closed up 13.16 at 1,06.46, down 12.47 for the week. I'm guessing stocks have one more leg up in their rebound rally from the great fall, but one way or the other, I don't want to own stocks. Stay away from them, they're locked in a bear market and have another 80% to lose against silver and gold prices.

SILVER and GOLD performed with breath-taking strength this week. The Gold Price rose $38.80 (4.1%) to close the week at US$995.80. Plainly next week GOLD will be hammering on $1,000's gate. It may fall back a bit, even as far as 981, to get a running start, but it will most likely pierce US$1,000 this next week.

SILVER rose 148.4 cents this week, 10%, to close the week at 16.268, a new high since last November's bottom at 880 cents. That's right, do that math: silver stands at 185% of its November low. What is most amazing is that 120 cents of that rise came in two days' trading this week.

Cowardice makes me want to hedge what I say, or maybe that's experience, but look at this: the silver price did not rise 120 cents after running through a long rally. Oh, no, it traded into a long triangle in a 10 month correction, then made that huge gain in two days breaking out of a triangle. Gold behaves similarly.

That argues that this rally is only beginning, and not about to end. Now this might be the bull trap to end all bull traps, but logic and the chart says silver and gold prices are just starting their most explosive upmoves. Once the gold prices passes $1,000.00 with a consecutive two-day close over that number, it will never trade below $1,000 again. And silver will tag right along for the ride.

Next week metals may correct, giving y'all a single last chance to buy. Once the gold price closes above $1,000, just buy. It will run away.

Dow in Silver Ounces fell below 600 this week, so it's starting another big move. And the gold/silver ratio dropped 4.6% to close below 62 at 61.2

Please note that our office will be closed on 14 September through 18 September for a family vacation.

On Monday, 21 September 2009 at 6:00 p.m. I will be speaking in Columbia, South Carolina on "Surviving the Depression & Reviving Local Economies." Location will be Columbia Conference Center (803) 772-9811 169 Laurelhurst Ave. Columbia, South Carolina 29210 Y'all are welcome to come join us.

Y'all enjoy your weekend.

Argentum et aurum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2009, The Moneychanger. May not be republished in any form, including electronically, without our express permission.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.