| 19-Oct-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,173.30 | -10.30 | -0.87% |

| Silver Price, $/oz | 15.83 | -0.27 | -1.70% |

| Gold/Silver Ratio | 74.123 | 0.617 | 0.84% |

| Silver/Gold Ratio | 0.0135 | -0.0001 | -0.83% |

| Platinum Price | 1,013.40 | -7.90 | -0.77% |

| Palladium Price | 687.60 | -11.30 | -1.62% |

| S&P 500 | 2,033.60 | 0.55 | 0.03% |

| Dow | 17,230.54 | 14.57 | 0.08% |

| Dow in GOLD $s | 303.58 | 2.90 | 0.96% |

| Dow in GOLD oz | 14.69 | 0.14 | 0.96% |

| Dow in SILVER oz | 1,088.54 | 19.36 | 1.81% |

| US Dollar Index | 94.95 | 0.37 | 0.39% |

|

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

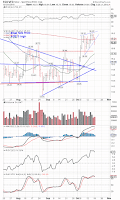

We're in the valley of decision here. The GOLD PRICE needs to remain above $1,163 and silver above $15.60 for the rally to remain alive.

|

| Silver Price |

|

| Gold Price |

Since August both silver and gold prices have maintained a steady uptrend, bettering previous highs, but this uptrend is embedded in a four year downtrend. It must keep on rising to prove itself, or else it's no more than preparation for dashed hopes. And I have no crystal ball, no trend-sniffing dog, no clairvoyance to tell, I just have to sit and watch with y'all, occasionally dabbing the blood off my quick-bitten nails.

Sometimes the NGM's manipulation efforts are simply hilarious. If you look at the Dow Chart. You will no doubt notice that it remained underwater -- lower than Friday -- the entire day until about ten minutes before the close. The S&P500, it did poke a nostril above unchanged about noon, but then dropped like a Jumbo Jet out of gas until a little before two, when help arrived. Still, by 4:00 p.m. it had only poked a little sliver above unchanged.

But lo, what mattereth such trifles? Important thing is the headline for the rubes, "Stocks up for the day!" I don't know about y'all, fellow mushrooms, but I'd prefer a higher quality hogwash, a lie that really might fool somebody. Corporate socialism is so sorry -- can't even produce a decent liar.

Stocks ROSE today. Dow perked up a mighty 14.57 (0.08%) just in time for the closing bell. S&P500 leapt, yea, leapt 0.55 (0.03%) to 2,033.66.

I wonder if it will get to the point where they don't even bother having markets any more, but just announce the price every day and applaud?

Y'all just think I'm grumpy and resentful, but that's not all the burr that's under my saddle. Markets are not merely a price-discovery mechanism, but also must be a value-discovery mechanism to serve the economy. Otherwise, they're just a liar's convention.

|

| Dow in Gold |

|

| Dow in Silver |

Why, y'all ask, does he keep harping on the Dow in Gold and the Dow in Silver? To filter out the noise. When I view the raw Dow alone or raw gold or silver, I don't see directly stocks' trend against metals, and THAT is what I want to know, to remain on the right side of that trend. THAT tells me how the future will unroll. And it says that stocks have turned DOWN against silver and gold, UNLESS the Dow in gold can rise above 16.50 oz, the summer's (and the recovery's) high and the Dow In Silver above 1,236.37 oz.

|

| US Dollar |

So even though it remains submerged far below its 200 DMA AND the 20, 50, and 200 DMAs are lined up bearishly, the scrofulus fiat scum is rallying.

That makes trouble for silver and gold prices. There's more bad news. The US Dollar has a habit (last five years) of making yearly lows in October's second half. Trouble comes immediately when the dollar breaches 95.57 upward.

Euro closed down 0.28% to $1.1326 and has burned up almost all its October gains. Yen has done the same, and closed today at 83.67, down 0.5%.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.