| 20-Apr-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,193.50 | -9.40 | -0.78% |

| Silver Price, $/oz | 15.88 | -0.34 | -2.08% |

| Gold/Silver Ratio | 75.143 | 0.986 | 1.33% |

| Silver/Gold Ratio | 0.0133 | -0.0002 | -1.31% |

| Platinum Price | 1,147.30 | -18.70 | -1.60% |

| Palladium Price | 773.05 | -10.55 | -1.35% |

| S&P 500 | 2,081.18 | 19.22 | 0.93% |

| Dow | 18,034.93 | 208.63 | 1.17% |

| Dow in GOLD $s | 312.37 | 6.03 | 1.97% |

| Dow in GOLD oz | 15.11 | 0.29 | 1.97% |

| Dow in SILVER oz | 1,135.49 | 36.52 | 3.32% |

| US Dollar Index | 97.53 | -0.08 | -0.08% |

|

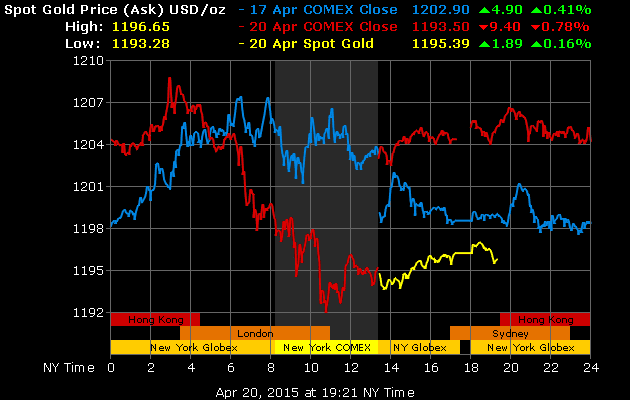

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

|

| Gold/Silver Ratio |

Gold only repeated its performance of the past fortnight, dancing above & below 1,200. Today's $1,190.80 low was not the lowest of the series, That came at $1,183.50 last Tuesday. Momentum indicators are negative. If gold doesn't suddenly turn around, it will fall further.

The SILVER PRICE closed only pennies above the uptrend line from the 1 December 15 low. Tomorrow it stands at $15.77. Yet silver has formed a falling wedge & that might turnaround. Most of the witnesses, however, point further down.

Last week I talked about rounding bottoms forming in silver & gold prices. Those bottoms tomorrow give the gold price a safety net about $1,160 & silver stopped right at it today. Breaking out the bottoms of those bowls would blow icy breath on us.

Chinese authorities on Friday announced measures to slow down the smoking stock market there. I reckon they waxed fearful of the outcome, because early today they announced new loose money measures. If you can believe the media reports today, that's what pumped the US stock market.

Shanghai stock exchange has doubled in the last nine months. Explosion waiting for a spark. Might blow up more than China.

Stocks gave us another taste of rank volatility today, surging after plunging on Friday. Dow shot up 208.63 (1.17%) to 18,034.93. Not quite as enthusiastically the S&P500 rose 19.22 (0.92%) to 2,100.40.

Oddest thing, that close at 18,034.93. It almost matched the close on 14 April at 18,036.70. If you look at the three intervening trading days, the indices shot up, clawed for footing without catching, then plunged the third day (Friday). Okay, so both closed above their closely spaced 50 & 20 DMAs after Friday's plunge below them. Somehow, today's boozy bounce, drunk on Chinese monetary mismanagement, doesn't leave me overawed, awed, or even slightly awed. Just looks like sawing back and forth from a topping market that hath not enough juice to make new highs. But what do I know, a ridge-runner who was only introduced to shoes last week?

Dow in gold zigged up, regaining most of last week's loss. Ended up 2.03% at G$312.35 gold dollars (15.11 oz). Dow in silver made a new high for this leg at $1,467.55 silver dollars (1,135.06 troy oz). Both are still safely within the gator jaws.

US dollar index has had a lot of the pride & brashness knocked out of it. Still, it added 43 basis points today (0.44%) to close at 98.14. This came barely under the 20 DMA (98.15). Sometimes those tiny differences are portentous. Dollar index bounced off an internal trend line. Let's see if it can fight that downtrend and rise again tomorrow.

Euro lost 0.58% to $1.0738, down below its 20 DMA again. Just can't get ahead, that euro. Japanese yen lost 0.25% to 83.86, but it ain't trying to get ahead.

WTIC rose 0.55% to $56.38/barrel. It hath made good its escape from the trading range into a rally.

I won't be publishing a daily commentary tomorrow because I'll be finishing my monthly Moneychanger newsletter for paid subscribers. See y'all Wednesday, God willing.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.