| 7-Apr-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,210.60 | -8.00 | -0.66% |

| Silver Price, $/oz | 16.83 | -0.27 | -1.58% |

| Gold/Silver Ratio | 71.952 | 0.668 | 0.94% |

| Silver/Gold Ratio | 0.0139 | -0.0001 | -0.93% |

| Platinum Price | 1,173.30 | -6.60 | -0.56% |

| Palladium Price | 768.70 | 0.20 | 0.03% |

| S&P 500 | 2,076.33 | 4.29 | 0.21% |

| Dow | 17,875.42 | -5.43 | -0.03% |

| Dow in GOLD $s | 305.23 | 1.91 | 0.63% |

| Dow in GOLD oz | 14.77 | 0.09 | 0.63% |

| Dow in SILVER oz | 1,062.43 | 16.46 | 1.57% |

| US Dollar Index | 98.12 | 1.16 | 1.20% |

|

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

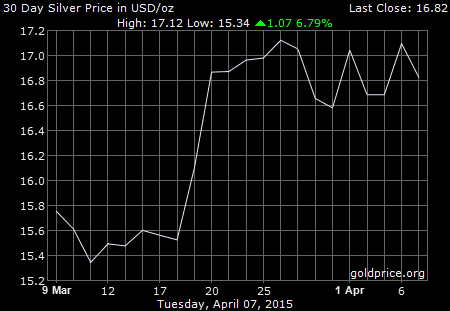

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

The GOLD PRICE rose 17.70 on Monday for a Comex close at $1,218.60 and a high at $1,224.50. Today it fell back $8.00 to $1,210.60. I told y'all this was going to be tough resistance.

The SILVER PRICE Monday rose 40.9 cents to $17.095 at Comex closing. Today it gave back 27 cents to perch at $16.825.

Recall that the March 1 GOLD PRICE high came at $1,223.00, so sellers were bound to come in at that level. Yet this also takes gold above its 50 DMA ($1,209.35). Bonus: It is above that neckline we've been watching since November, too. I don't believe this little move has exhausted itself, and it should reach at least the 200 DMA, now at $1,236.50, or, say, $1,240.

Silver looks better still, although I don't like that high yesterday at $17.31, which I find too low. Yet it remains above the 50 DMA and that neckline. 200 DMA hovers above at $17.76. Rally has not ended.

That bullish flag on the GOLD/SILVER RATIO chart did not pan out, and the ratio later traded up to fill that gap it had left behind. However, it remains below its 20 DMA (72.09) and today closed 71.952. Remember, that ratio usually falls when metals rally. Interesting here: silver since December has been slightly stronger than gold (= the ratio has been dropping). Usually silver lags back as a rally begins, then outruns gold. Not this time, and I find it encouraging for silver that is has been outperforming gold. It implies the market finds silver undervaluation too outrageous to abide, so investors must keep buying. Yes, yes, this is a marginal event, but not to be scorned. Do not despise the day of small beginnings.

The yankee government issued its lying jobs report on Friday when all the markets were closed, a typical sneak attack. However, the report upset markets on Monday, driving the US dollar down 83 basis points to 96.96, lowest point in the present move, but not quite as low as that two weeks ago. Thus it leaveth behind a riddle: hath it turned up?

Stocks rose on Monday, expecting I suppose more inflation & later rising interest rate. But today they could not sustain any higher move and in fact sank. Dow lost a minimal 4.53 (0.03%) to 17,875.42 while the S&P lost 4.29 (0.21%) to 2,076.33.

Forget what the man behind the curtain says, stocks continue in a downtrend begun with the 2 March highs.

US dollar index recovered 116 basis points today to close at 98.12.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.