| 9-Jan-15 | 16-Jan-15 | Change | % Change | |

| Gold Price, $/oz. | 1,216.00 | 1,276.90 | 60.90 | 5.0 |

| Silver Price, $/oz. | 16.386 | 17.739 | 1.353 | 8.3 |

| Gold/Silver Ratio | 74.210 | 71.983 | -2.227 | -3.0 |

| Silver/gold ratio | 0.0135 | 0.0139 | 0.0004 | 3.1 |

| Dow in Gold $ (DIG$) | 301.53 | 283.50 | -18.04 | -6.0 |

| Dow in gold ounces | 14.59 | 13.71 | -0.87 | -6.0 |

| Dow in Silver ounces | 1,082.47 | 987.18 | -95.29 | -8.8 |

| Dow Industrials | 17,737.37 | 17,511.57 | -225.80 | -1.3 |

| S&P500 | 2,044.81 | 2,019.42 | -25.39 | -1.2 |

| US dollar index | 92.16 | 92.99 | 0.83 | 0.9 |

| Platinum Price | 1,229.10 | 1,269.80 | 40.70 | 3.3 |

| Palladium Price | 800.15 | 754.30 | -45.85 | -5.7 |

|

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

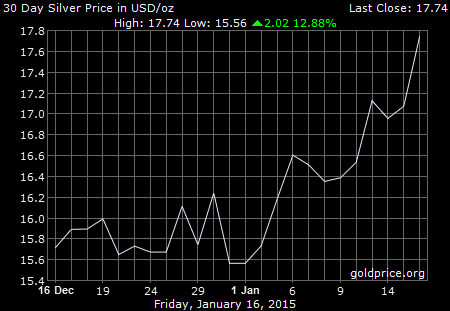

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

The GOLD PRICE today added $12.20 (1%) to close Comex at $1,276.90. Silver gained 3.9% -- yes, yes -- or 66.6 cents to close at $17.739.

|

| Silver Price |

|

| Gold Silver Ratio |

Don't miss this: The GOLD PRICE today cleared both the last high, $1,255.60, but also for the first time in a long time the 200 day moving average ($1,255.53). Rising on rising volume, all indicators poking up like tulip shoots in March. On the WEEKLY chart the gold price closed way above the downtrend line and most importantly, above the 50 week moving average ($1,267.74). Silver closed above its 20 week moving average ($16.99).

Great week, now BUY THE BREAKOUT.

Here's more on the Swiss National Bank's surprise removal of its peg to the euro: the franc soared 32% in 30 minutes. Try to wrap your head around that, in a market where a 1% daily move is huge. The SNB's surprise party sent earthquake tremors through all markets, and could be the death knell of the euro (just to mix my metaphors. Actually, the 1812 New Madrid Fault earthquake in West Tennessee caused church bells to ring in Columbia, South Carolina, so maybe it's not mixing metaphors after all.) From such catalysts as yesterday's SNB surprise come great and global panics. The damage done to those with Swiss franc or euro positions, Swiss stocks, and currencyand other derivatives will likely be catastrophic. (First casualty: FXCM online trading service bailed out by Leucadia today.)

Here's an example: founded in 1820, the Credit-Anstalt bank was one of the largest in imperial Austria. Credit-Anstalt declared bankruptcy on 11 May 1931 it became the first bank domino in the tumbling chain of dominos worldwide that turned a recession into the Great Depression. "Credit-Anstalt was too big to fail, but too big to save."

It gets much worse. On 14 January Russia completely shut off gas shipped via Ukraine today, shipments headed to Bulgaria, Greece, Macedonia, Romania, Croatia, and Turkey. They also cut off all gas to Ukraine as well. The US and Europe have been stupidly picking a fight with Russia they may get a war.

Worse yet, falling oil prices will severely reduce dollar revenue of oil producing countries. Fewer petrodollars means fewer petrodollars to recycle into the US economy bank deposits and financial assets. From a net surplus of dollars to deposit in US banks and to use to pay their bond interest and principal, the flow of petrodollars will become net negative, which means that more of those oil revenues will become not petrodollars, but domestic deposits and investments. Bad, bad juju. Read more in Zero Hedge article here, http://bit.ly/1G9Wyu7

I try not to be an alarmist, but all this is alarming. Better protect yourself.

Stocks experienced their first up day in six days today. Dow added 190.86 (1.1%) to 17,511.57. S&P500 gained 26.75 (1.34%) to 2,019.42. Today's rise did them not a particle of good, since they remain far below their 20 and 50 day moving averages in a firm downtrend. Better lay in a load of aspirin and Alka-Seltzer for next week if you own stocks.

Dow in gold is tantalizingly close to its 200 day moving average. Lost 0.3% today to close at G$282.779 gold dollars (13.68 troy ounces) while the 200 DMA lurks below at G$280.72 (13.58 oz). Once it ruptures that 200 DMA twill sink like your aunt's bank balance when she watches the Shopping Network.

Dow in silver -- YEA! -=- fell out of the lower Gator Jaw today, as gold did yesterday. Whew! Lost 3.62% today to end at S$1,273.06 silver dollars (984.63 troy oz). Next milestone is the 200 dma at S$1,202.17.

Both have fallen out of the Gator Jaws (broadening top) pattern, both show indicators firmly down.

US dollar index rose 42 basis points (0.46$) to close at a new high for this move, 92.99. Euro lost 0.55% to close at a new low for the move, $1.1561. Yen lost 1.43% to end at 85.02, but still uptrending.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.