| 8-Jan-15 | Price | Change | % Change |

| Gold Price, $/oz | 1,208.40 | -2.20 | -0.18% |

| Silver Price, $/oz | 16.35 | -0.16 | -0.96% |

| Gold/Silver Ratio | 73.904 | 0.578 | 0.79% |

| Silver/Gold Ratio | 0.0135 | -0.0001 | -0.78% |

| Platinum Price | 1,221.70 | 1.00 | 0.08% |

| Palladium Price | 793.10 | 0.65 | 0.08% |

| S&P 500 | 2,062.14 | 36.24 | 1.79% |

| Dow | 17,907.87 | 323.35 | 1.84% |

| Dow in GOLD $s | 306.35 | 6.08 | 2.02% |

| Dow in GOLD oz | 14.82 | 0.29 | 2.02% |

| Dow in SILVER oz | 1,095.22 | 30.13 | 2.83% |

| US Dollar Index | 92.57 | 0.36 | 0.39% |

|

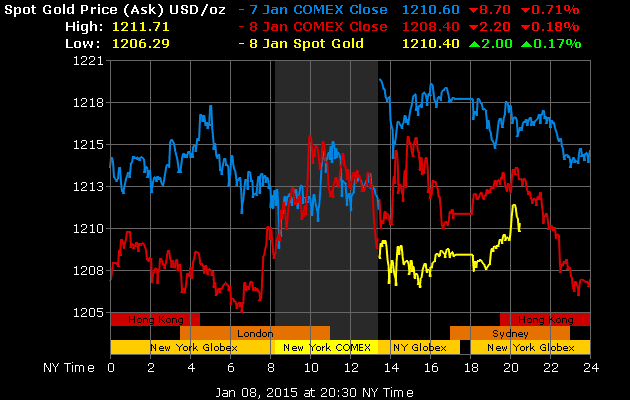

| 3 Day Gold Price Chart |

|

| 30 Day Gold Price Chart |

|

| 5 Year Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

|

| 5 Year Silver Price Chart |

|

| Gold in Euro |

Euro Gold is the most dramatic, breaking above 15 month resistance about 990 - 1000 to close at 1,025 today. Chart's on the upper right:

|

| Gold in Yen |

|

| Gold in British Pounds |

This GOLD PRICE strength against other scrofulous, scurvy fiat currencies is exactly what we want to see. Once the dollar breaks, the gold price will soar.

But its wings were clipped today. Gold dropped $2.20 (0.18%) to $1,208.40. The SILVER PRICE dropped 0.96% or 15.9 cents to $16.531.

Yes, yes, gold dropped below $1,210, but it is correcting, now isn't it? Remains above 20 and 50 DMAs ($1,198.59 and $1,191.59 and $16.16 and $16.19). That 20 DMA might make a good target for 'em.

GOLD/SILVER RATIO went the wrong way today, rising to 73.904, above the 50 dma but below the 20. It is possible that silver might trade as low as $15.75 and the gold price as low at $1,200 - $1,190 just to scare the life out of us, but they won't fall off the face of the earth. This is just a little correction.

. . . he said, biting his nails.

The heart of contrarian investing is to watch what the crowd does, and do the opposite. Right now, you couldn't find a radioactive dollar bear with a Geiger counter, because there ain't no dollar bears, period. Everybody's convinced the dollar is going higher, which means they've already placed their bets that way. Trouble is, who's left to buy it, if everybody already has?

Their case is built on expecting the Fed will raise interest rates, but how can the Fed do that in the face of a struggling economy? Worse yet, a rising dollar wreaks havoc on American industries' ability to compete overseas. Whoops, it also has some debt default implications for all those borrowers outside the US, some of them sovereign nations, who have to pay back now more expensive bucks.

Long and the short is, the Fed will shortly find its fingers in the wringer and begin exercising their jawbones to talk the dollar down. Either that, or they've lost their feeble minds and in fact want and intend to destroy the American economy.

That's certainly one explanation.

Stocks kept on jubilatin' today, the Dow rising 323.35 (1.84) to 17,907.87. S&P500 rose 36.24 (1.79%) to 2,062.14. That puts both indices above their 20 and 50 day moving averages. Give 'em another day or two to see what they have in mind, but I am still inclined to favor gravity.

Dow in gold and Dow in Silver tangled their feet in the 20 and 50 day moving averages, coming up from beneath. DiG closed at G$306.15 (14.81 troy ounce). Funny how nobody at all thinks of the Dow in Gold DOLLARS, but it still has clustered around that G$300 gold mark. (G$20.6718 = 1 troy ounce)

Dow in silver climbed 2.8% to S$1,413.96 silver dollars (1,093.61). (S$1.2929 = 1 troy ounce).

Both remain in the Gator Jaws pattern, ready to fall out of that broadening top.

US dollar index is just a-climbin' and a-climbin', with no end in sight, except the one I discussed above. Dollar index is hugely overbought on the RSI. Today it added 36 basis points (0.4%) to close at 92.57.

Euro fell more, to a new low at $1.1793, down 0.38% while the Yen also fell 0.38% to 83.56c/Y100.

WTIC rose again today, 0.08% to US$48.79/barrel.

On 8 January 1835 for the first and only time US government debt reached zero, in the presidency of Andrew Jackson, who, y'all may not know, came from Tennessee.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.