| 12-Aug-14 | Price | Change | % Change |

| Gold Price, $/oz | 1,308.80 | 0.30 | 0.02% |

| Silver Price, $/oz | 19.87 | -0.00 | -0.01% |

| Gold/Silver Ratio | 65.868 | 0.021 | 0.03% |

| Silver/Gold Ratio | 0.0152 | -0.0000 | -0.03% |

| Platinum Price | 1,471.90 | 0.60 | 0.04% |

| Palladium Price | 878.60 | 3.30 | 0.38% |

| S&P 500 | 1,933.75 | -3.17 | -0.16% |

| Dow | 16,560.54 | -9.44 | -0.06% |

| Dow in GOLD $s | 261.56 | -0.21 | -0.08% |

| Dow in GOLD oz | 12.65 | -0.01 | -0.08% |

| Dow in SILVER oz | 833.44 | -0.40 | -0.05% |

| US Dollar Index | 81.57 | 0.05 | 0.06% |

|

| 3 Day Gold Price Chart |

|

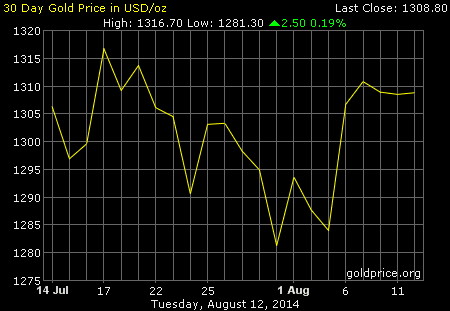

| 30 Day Gold Price Chart |

|

| 3 Day Silver Price Chart |

|

| 30 Day Silver Price Chart |

Gold was trading along fine, reaching a high of $1,319.30, until about 2:30 Eastern time when sellers took over and slapped gold winded, down from $1,314 to $1,308.20. Silver traded up until nearly 10:00 a.m., reaching 2016c, but then steadily stepped downstairs the rest of the day.

Whenever a market climbs higher during a day, then falls back to close unchanged or lower -- and a 30 cent rise in the GOLD PRICE is "unchanged" -- it's bad news. Now it might be on the first day of a rise somehow it got confused, but most of the time that signals that sellers up there at higher prices are more determined than buyers. Wherefore y'all brace yourselves for lower prices tomorrow.

The 2000c mark has been the divider for the SILVER PRICE. It wasn't able to pierce that for a while, now when it does, it falls back below it. 'Tain't stout.

All this runs contrary to what I have been expecting, namely, that both metals begin a rally around mid-month, but today raises the suspicion they have not found a solid bottom yet.

Silver and gold prices might give us a chance to buy at lower prices.

Stocks had a hard time holding on to yesterday's gains, and didn't. Dow coughed up 9.44 (0.06%) to 16,560.54, and volume is drying up like barn paint in the sun. S&P500 lost 3.17 (0.16%) to 1,933.75, weaker than the Dow. Mercy, there's more plungin', plummetin', and pukin' to come.

Dow in Gold hooked down a fraction, 0.13%, while the Dow in silver rose 0.39% and crossed above its 50 DMA at 827. It closed 831.35 oz.

US dollar index closed at 81.57, up a measly 5 basis points, but closed near the day's low. Euro gapped down today, lost 0.14% to $1.3367 and ain't going nowhere but down. Yen looks as sorry as electronics made in China and sold at WalMart, down 0.07% to 97.79.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.