| 1-Aug-14 | 8-Aug-14 | Change | % Change | |

| Gold Price, $/oz. | 1,293.60 | 1,308.90 | 15.30 | 1.2 |

| Silver Price, $/oz. | 20.332 | 19.902 | -0.43 | -2.1 |

| Gold/Silver Ratio | 63.624 | 65.767 | 2.143 | 3.4 |

| Silver/gold ratio | 0.0157 | 0.0152 | -0.0005 | -3.3 |

| Dow in Gold Dollars (DIG$) | 263.57 | 261.44 | -2.12 | -0.8 |

| Dow in gold ounces | 12.75 | 12.65 | -0.10 | -0.8 |

| Dow in Silver ounces | 811.20 | 831.77 | 20.57 | 2.5 |

| Dow Industrials | 16,493.37 | 16,553.93 | 60.56 | 0.4 |

| S&P500 | 1,925.15 | 1,931.59 | 6.44 | 0.3 |

| US dollar index | 81.43 | 81.46 | 0.03 | 0.0 |

| Platinum Price | 1,463.80 | 1,481.30 | 17.50 | 1.2 |

| Palladium Price | 865.50 | 861.00 | -4.50 | -0.5 |

|

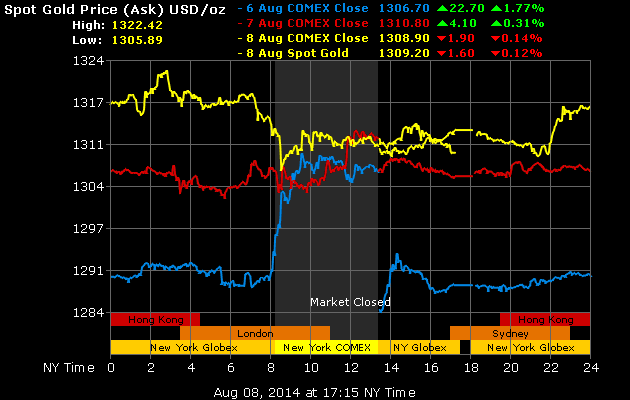

| 3 Day Gold Price Chart |

|

| 3 Day Silver Price Chart |

The gold price lost $1.90 to $1,308.90 today while silver fell 4.9 cents to 1990.2c.

The GOLD PRICE punched through the downtrend line form October 2012 today, a new high for the move, as high as $1,324.30, but couldn't hold on there and fell back under the line. That's lousy and the first half of a key reversal. A lower close on Monday confirms that reversal.

The gold price rose 1.2% this week while silver fell 2.1%. That suggests that gold's rise was gassed by the Ukraine crisis. The SILVER PRICE never even rose above its 200 DMA this week.

Not far away at about 1960c stands the downtrend line from the August 2013 high. If silver doesn't catch there it could drop to 1860c. What's in favor of it stopping there? Well, it broke out through that line in June, and markets quite often trade back to a resistance line they have broken for a final kiss goodbye before moving higher.

I don't expect silver and gold prices to tumble significantly. The gold price might hit $1,270, silver 1930c, but I believe they have turned up and, either after one more little low or immediately trade high the rest of the month in an August rally, classic time for precious metals rallies to begin.

Dow continues on a confirmed monthly key reversal (=break into new high ground with a lower close than the previous month, confirmed by a lower close in the next month).

Today the Dow rose 185.66 (1.13%) to 16,553.93 while the S&P500 rose 22.02 (1.15%) to 1,931.59. It appears that the Dow is doing no more than bouncing off its 200 DMA (16,348.82). MACD still calls for lower prices, but stocks probably will rally a bit to work off their oversoldness.

Like silver and gold, the Dow in Gold and Dow in Silver are contradicting each other. Dow in gold rose today, 1.44% to 12.63 oz (G$261.08 gold dollars), but from a hair's breadth above the uptrend line from August 2011 (12.452 oz against 12.4 oz or G$257.41 against G$256.33). All indicators call for lower prices, and the DiG is below all its moving averages, so momentum is firmly down.

Dow in Silver, on the other hand, has an upward correction that has not yet turned down. More, it punched into its 50 DMA today ($1,072.39 silver dollars or 829.43 oz). Today it rose 1.49% to S$1,074.89 (831.23 oz). Needs a close below $1,055.68 (816.5 oz) to confirm a downturn.

US dollar index, Parasite of Nations, Punisher of Savers, Terror of Investors, fell back below 81.50 support/resistance. Closed down 13 basis points to 81.46. May correct a little here before it resumes its rally. Euro rose 0.32% to $1.3406, but still looks like a motheaten old sweater you ought to throw away. Yen this week cancelled out the sell signal it flashed when it fell out of that triangle by trading back up into the gaps left behind. Still, that doesn't mean it's showing much strength -- bound in the same old range.

A reader has chided me for not giving proper credit and thanks for those medical personnel attending my friend Daniel and applying those means necessary to his recovery. He is right, and I thank God for each of them and their faithful, diligent service. They took Daniel off the ventilator today and he is recognizing people.

Y'all enjoy your weekend!

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.

- Franklin Sanders, The Moneychanger

The-MoneyChanger.com

© 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.

WARNING AND DISCLAIMER. Be advised and warned:

Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.

NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.

NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.

NOR do I recommend buying gold and silver on margin or with debt.

What DO I recommend? Physical gold and silver coins and bars in your own hands.

One final warning: NEVER insert a 747 Jumbo Jet up your nose.